US February import/export price index data now out 15 March

- 0.8% prev revised down from 1.0%

- mm ex petrol 0.5% vs 0.3% exp vs 0.5% prev

- yy 3.5% vs 3.5% exp vs 3.6% prev

- export price index mm 0.2% vs 0.3% exp vs 0.8% prev

- yy 3.3% vs 3.4% prev

Stronger headline but lower revision. Strong report overall though sees USD a little better bid

Data also out now US Empire State and Philly Fed outlook along with weekly jobless claims.

GBPUSD 1.3932 USDJPY 106.06 EURUSD 1.2343 finally breaking down through 1.2350

The Import Price Index released by the US Department of Labor informs the changes in the price of imported products into the US.The higher the cost of imported goods, the stronger the effect they will have on inflation, resulting in a higher probability of a rate rise.

Says the report:

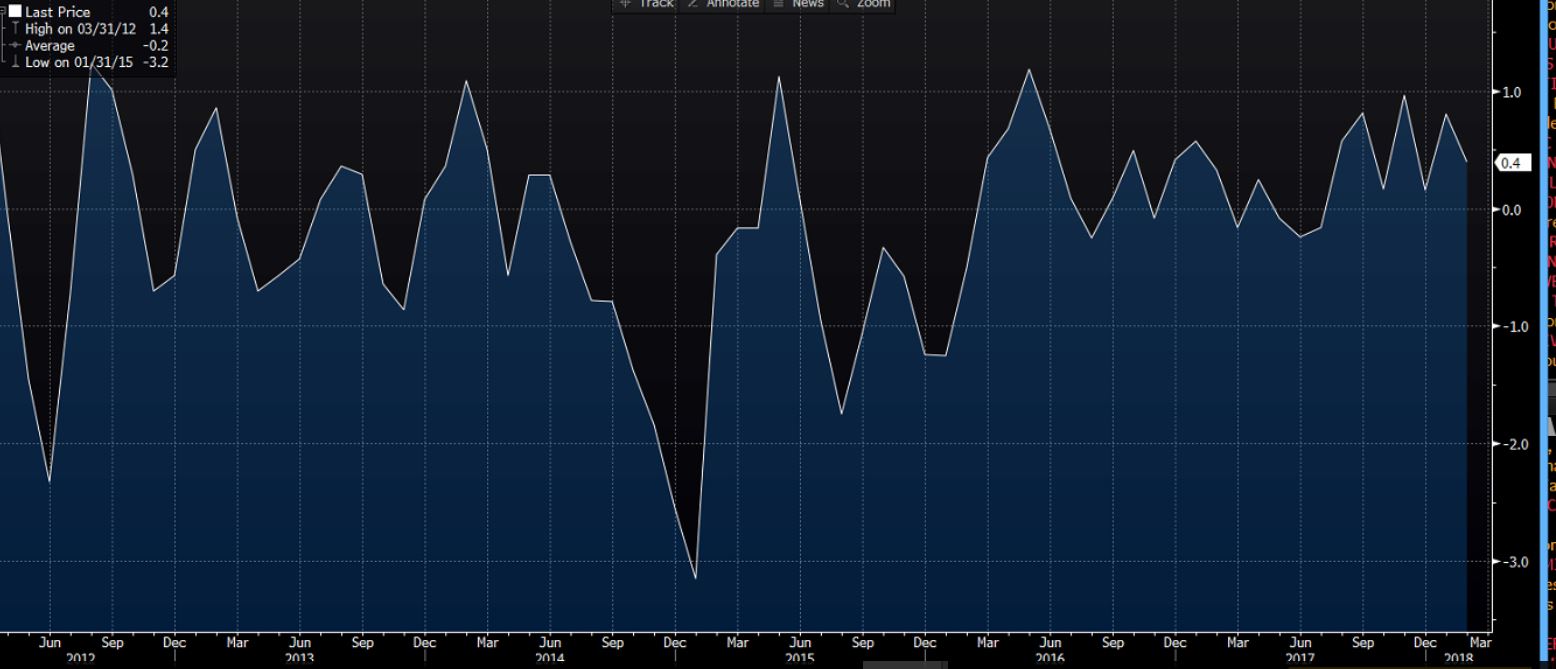

All Imports: The price index for U.S. imports rose 0.4 percent in February, the seventh consecutive

monthly increase, after advancing 0.8 percent in January. The last time the index declined on a monthly

basis was a 0.2-percent drop in July 2017. Import prices advanced 3.5 percent for the 12-month period

ended in February, matching the 12-month rise in November. Those were the largest annual increases since

the index rose 3.6 percent for the 12-month period ended April 2017.

Full release here