October US consumer price index data

- Prior was +0.1%

- CPI y/y +2.2% vs 2.2% exp

- Prior 2.0%

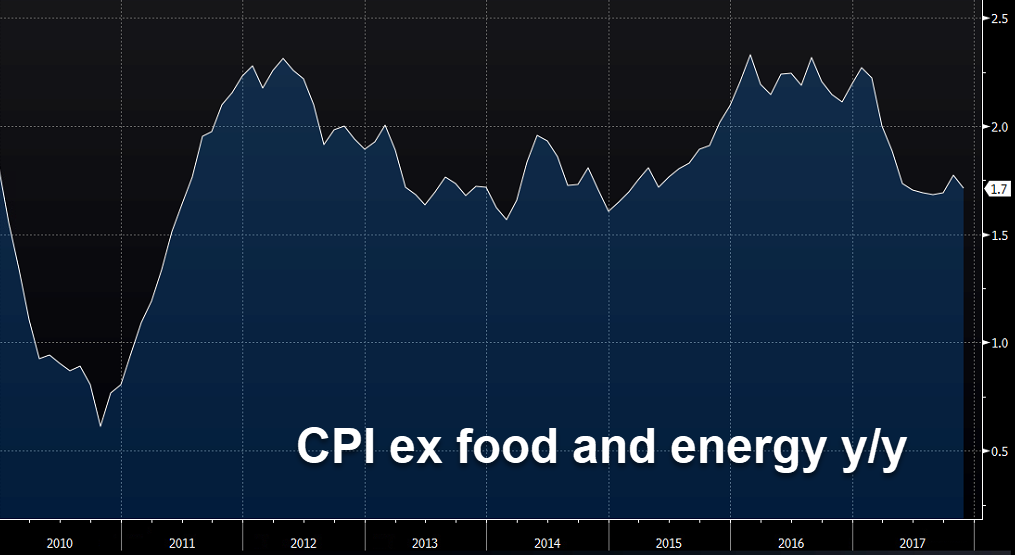

- Ex food and energy 1.7% y/y vs 1.8% exp

- Prior ex food and energy 1.8%

- Ex food and energy +0.1% m/m vs +0.2% exp

- Real average weekly earnings +0.8% y/y vs +0.4% prior (revised to +0.3%)

- Real avg hourly earnings y/y +0.2% vs +0.4% prior (revised to +0.2%)

- Real weekly earnings +0.1% m/m vs -0.1% prior

Weak report, driven mostly by energy and commodities. The soft real y/y wage growth along with the negative revision isn't a great sign, even if the m/m reading jumped.

The US dollar is down 20-30 pips across the board.

Looking through the details, higher gasoline costs were balanced by dropping healthcare and apparel costs. Gasoline prices rose 7.3% m/m while apparel was down 1.6% y/y. Food prices were unchanged for the second month but up 1.4% y/y.

Outside of energy prices, there are no signs of inflation in this data. Given that it's the last data point the FOMC will see, it could nudge them to a more-cautious state.