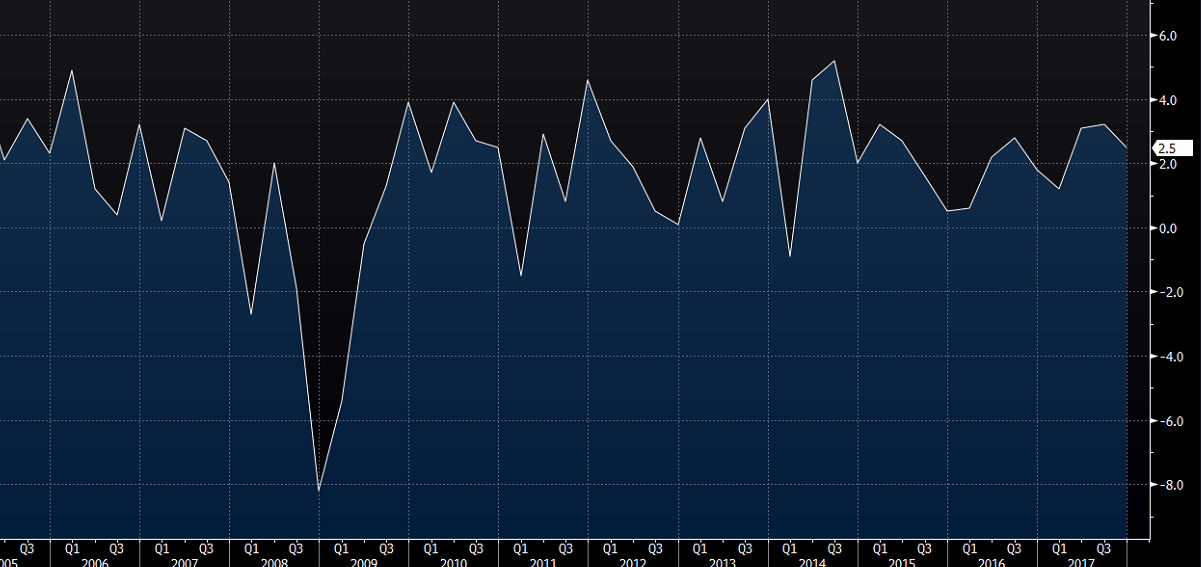

The second look at fourth quarter 2017 GDP

- The first reading was +2.6% (q/q annualized)

- Personal consumption +3.8% vs +3.6% exp

- Personal consumption in the first reading +3.6%

- Consumption rose at fastest rate since Q4 2014

- GDP grew 2.3% in 2017 versus 1.5% in 2016

- GDP price index 2.3% vs 2.4% exp

- Core PCE 1.9% vs 1.9% exp

The consumer did some heavy lifting in Q4 and that's expect to continue this quarter. At some point you would think that consumption would fall back in line with wage growth, but never underestimate the power of the US consumer (or his Visa).

Details:

- Business inventories cut 0.7 pp from GDP versus -0.67 pp in the first reading

- Exports +7.1% vs +6.9% previously

- Imports +14.0% vs +13.9% previously

- Business investment +6.6% vs +6.8% previously

- Final sales +3.3% vs +3.1% previously

The drop in inventories is the biggest change. Looking ahead, that will reverse in 2018 and add a tailwind. Estimates for Q1 range from 1.8% to 2.5% but it's still early.

The big story going forward will be trade. The deficit cut 1.13 percentage points from GDP and that looks set to worsen as imports climb to meet consumer and business demand after the tax cut.