Hike or no hike?

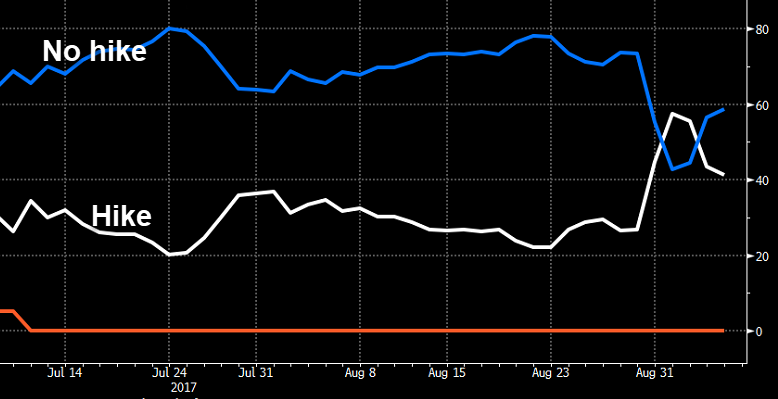

The Bank of Canada decision is due out in less than an hour (at 10 am ET) and the market isn't sure what's coming.

According to the overnight index swaps market, a hike is 41.2% priced in with the remainder pointing to no change. Interestingly, that's drifted lower from a peak of 57.4% last week.

So there is a slight bias towards holding rates despite the Canadian dollar hitting a two-year high yesterday.

A few other things stand out when looking at the probabilities. One is the low chance of a futures hikes. The market is pricing in just a 37% chance of yet-another hike this year if we get one today. Through 2018, only one hike is fully priced in, and that could come today. If it does, however, it's hard to believe more won't be behind it.

On net, the market has two hikes priced in by the end of 2018 and a 50/50 chance of a third.

I don't think the Bank of Canada will hike today or they will hike with a dovish signal. There is no real rush to tighten and back-to-back hikes would send the wrong signal, especially when the entire world is dealing with low inflation.

What do you think?