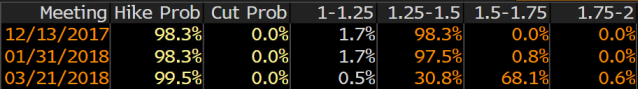

Fed fund futures indicate a 98.3% probability of a rate hike this week

Last week's November NFP report did little to change the fact that the Fed will surely raise rates again in its FOMC meeting this Wednesday.

The CME's FedWatch tool has the probability at 90.2% while OIS futures market has it at 100%. We're surely somewhere between 90% - 100% at this point as we approach the meeting, there's no doubting that.

There's not much on the economic calendar (significant ones at least) today, so the focus of the market could shift towards the FOMC meeting, but with so much already factored in - we should not expect the dollar to firm up too much.

And even if it does, it is very likely that this will be similar to other Fed hikes where we'll see the market react in a "buy the rumour, sell the fact" manner (or at least the initial reaction on the headline).

This will be Fed Chair Yellen's final FOMC meeting and press conference btw. And Jerome Powell is expected to adopt a similar approach to Yellen in 2018, which means data dependence again is one of the key factors in the Fed's approach. That will mean wage growth like the one we saw in last week's jobs report surely isn't very suggestive that a more aggressive tightening path is on its way in the next year.