The USD is lower

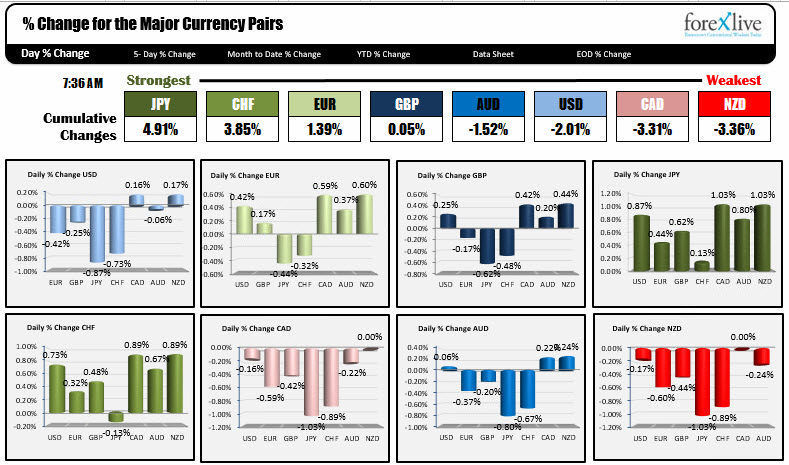

As the NA traders enter the fray, the JPY is the strongest, while the NZD is the weakest. The US is mostly lower as concerns about an escalated trade war has traders worried about the global implications.

Traders face another stock slide too which has the Pavlovian reaction of selling the USDJPY.

Stocks in the US are accelerating there fall in pre-market trading as the traders sit down. The S&P futures are down -23 points. The Dow futures are down -286 points and the Nasdaq futures are down -85 points. European markets are ugly again with Dax down -2.38%. The Nikkei fell -2.5%. Ouch.

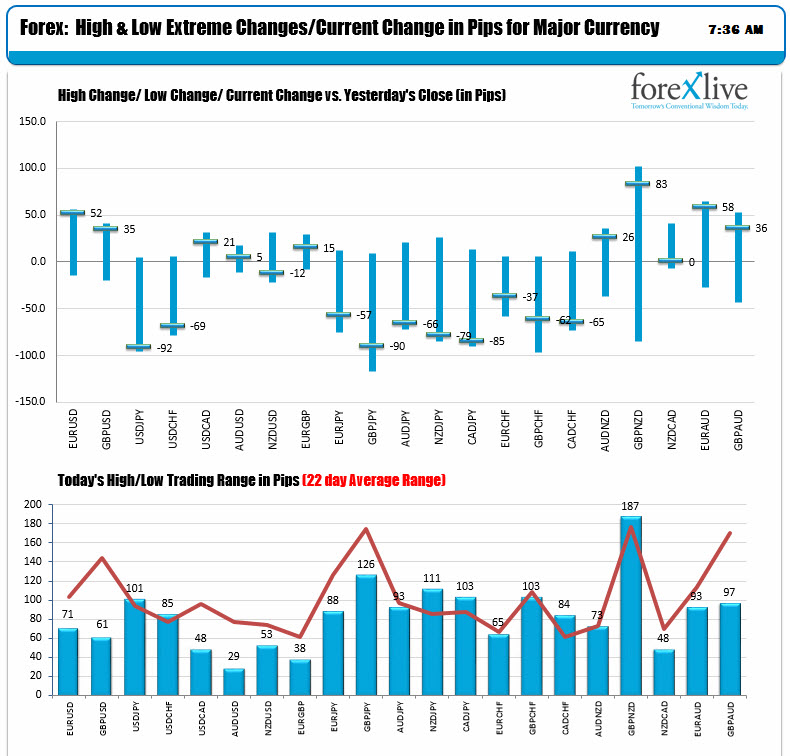

Looking at the ranges and changes, the focus is most on the JPY pairs and they are near low levels and also near their 22 day trading ranges. The GBPUSD is somewhat quiet. Mike points out a 1.3800 option expire and PM May's speech at the bottom of the hour. The EURUSD is trading at the session highs. That pair broke and based against the 100 hour MA and later cracked above its 200 hour MA at 1.22834 and moved higher. It trades above 1.2300 at 1.2314 now.

In other markets, the snapshot shows:

- Spot gold of $4 or 0.30% at $1321

- WTI crude oil futures are trading down $.30 or -0.49% at $60.69

In the US debt market yields are little higher:

- 2 year 2.215%, +0.3 basis points

- 5 year 2.581%, unchanged

- 10 year 2.813%, +0.5 basis points

- 30-year 3.10%, +1.7 basis points