Pick the pair. They are well of the highs

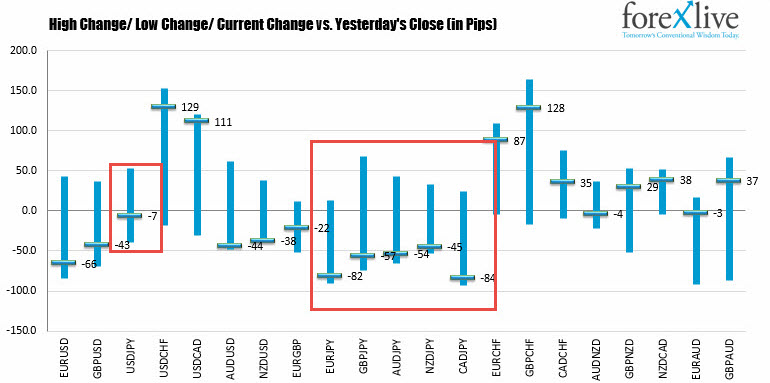

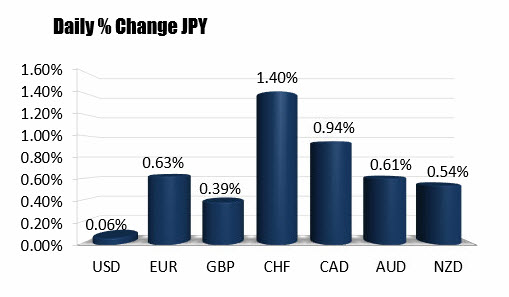

The below chart is showing how the JPY pairs are fairing as the Nasdaq tumbles. The JPY crosses were all higher on the day. They are now trading near the lows. The USDJPY is off it's high but overall the strength of the dollar has insulated the USDJPY's decline.

The snapshot of the largest mover shows that the CHFJPY and the CADJPY are leading the way with changes of 1.4% and 0.94%.

The CAD has been trending to the upside of late (until today). Today we are seeing a reversal lower. This is working into the CADJPYs downward momentum as well.

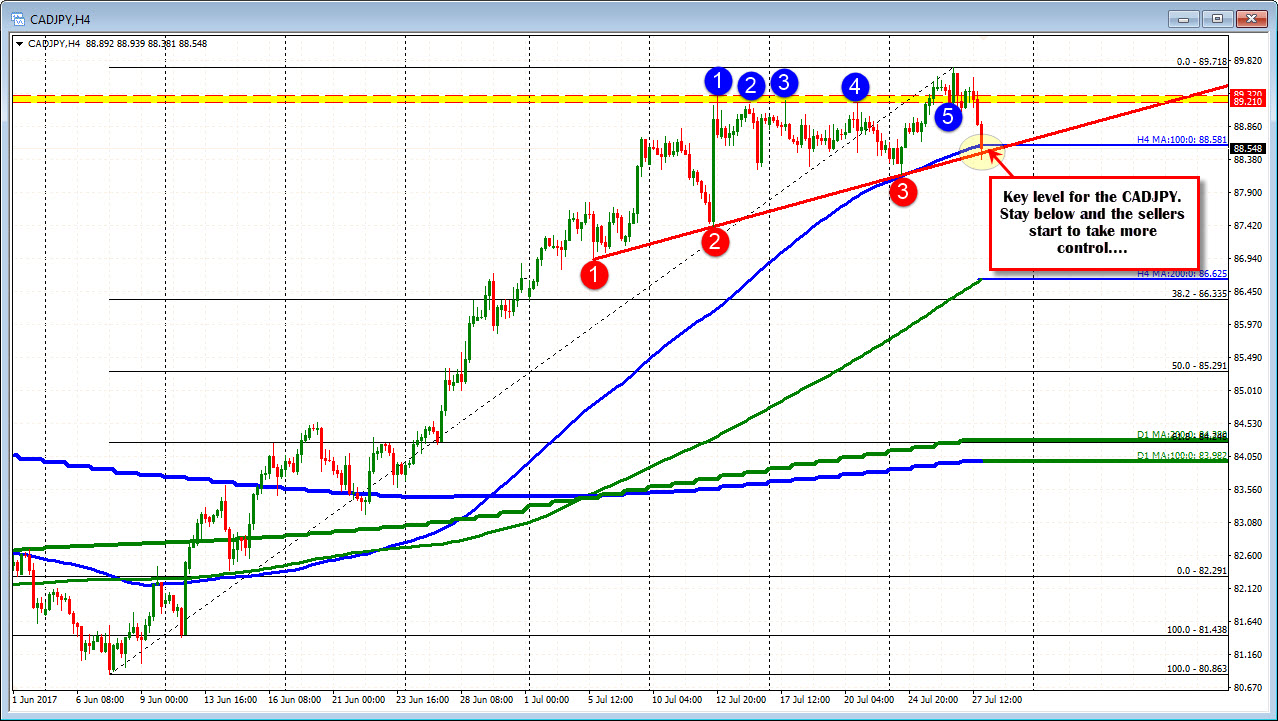

What does the pair look like technically?

Looking at the 4-hour chart, the move to the upside since early June has been dramatic. The high was reached yesterday at 89.718. That peak took out the highs from the prior 2-weeks at 89.21-33 (see yellow area in the chart below). The tumble today has the pair trading below its 100 bar MA on the 4-hour chart for the first time since June 13th (see blue line). That level comes in at 88.58. The price also fell below a trend line on the move lower. That should be more bearish but we area seeing a quick reversal off the lows that have the pair retesting the 88.58 level. If the correction can hold near the level, the shorts should gain more confidence for a further corrective move lower.