Broke above yesterday. First close above since June 9th

The Bank of Canada will announce their latest intentions for rates at 10 AM ET/ 1400 GMT

The expectations are for no change in rates. The probability of a hike stand at 17.8% for tomorrow. The chance of a hike rises to 44% for the December 6th meeting.

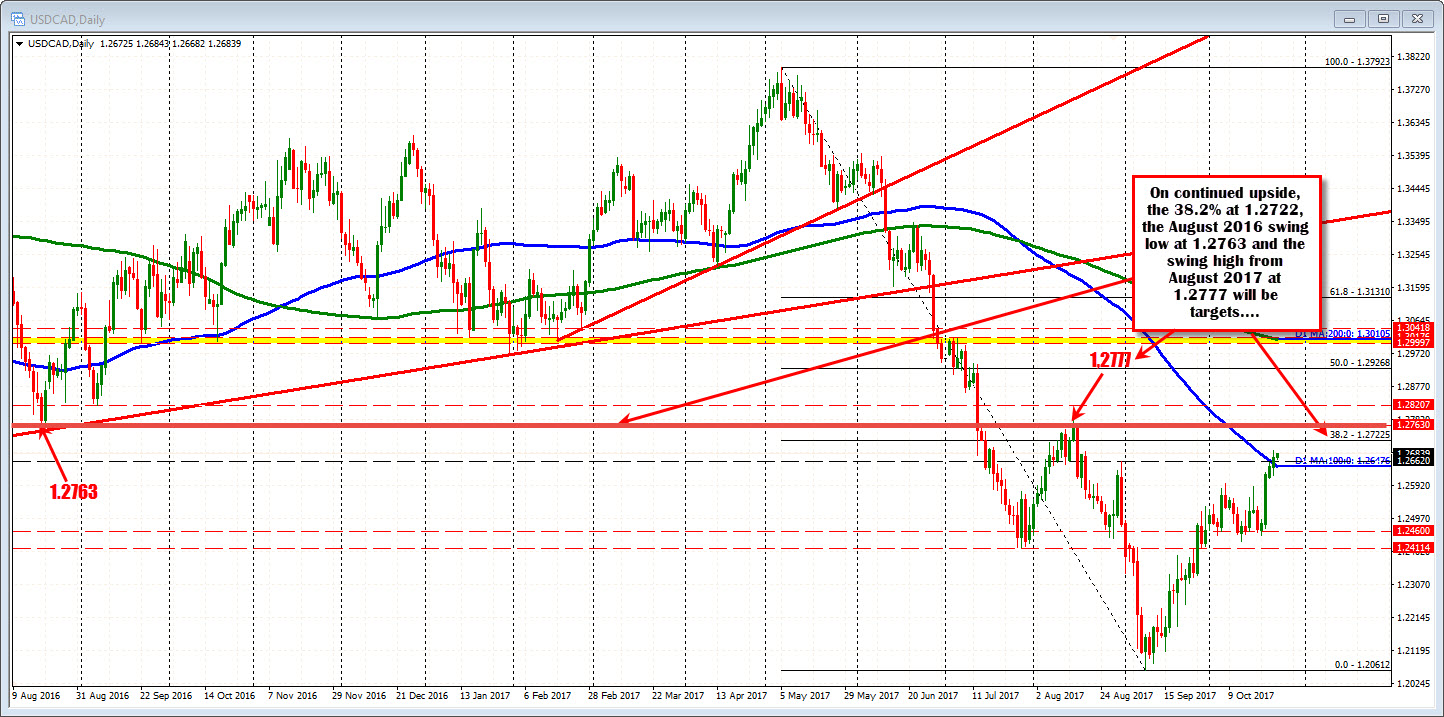

The Bank of Canada has had two hike in 2017. They came on back to back meetings in July and again at their last meeting in September where it was a close call for a 2nd hike. Two days after the hike the pair bottomed at 1.20612. The pair has moved steadily higher since then and currently trades at 1.2684.

Technically the rally higher has taken the price above the 100 day MA at 1.26476 level (currently). That MA is always a barometer for bullish and bearish. The high price has moved up to 1.26919 (yesterday it peaked there). It closed down at 1.2674 and trades at 1.2683 currently.

Looking at the hourly chart, the price move higher yesterday broke above a topside trend line but moved back below that line by the close. We are currently retesting that old trend line at the 1.2685 level. Hold it and we could/should see some selling. That could take the price back toward the 100 day MA. However, I would expect that the 100 day MA would stall a fall.

SUMMARY:

With the price here, the technical bias is more bullish. It will take a move back below the 100 day MA at 1.26476 to get the buyers to rethink (and sell) their longs (i.e profit take). A break back below would also likely attract more new sellers (new shorts).

If that does not happen and the price starts to push higher, the buyers are more in control.

Potential targets include the 38.2% of the move down from the May high at 1.27225. Above that will be swing low from August 2016 at 1.2763, and them the high from August 2017 which came in near that level at 1.2777 (see daily chart below).