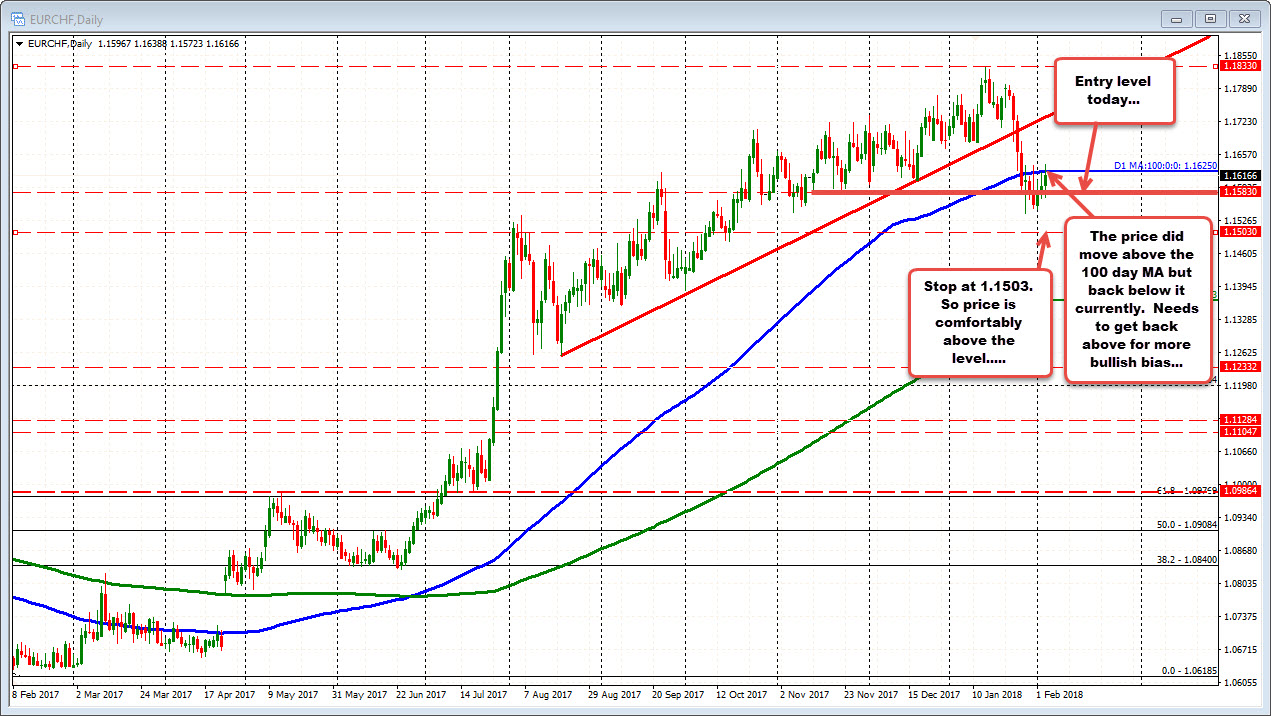

Bought at 1.1585 with stop at 1.1503 and TP at 1.1833

Eamonn outlined Barclay's trade of the week earlier today:

- Buy EURCHF at 1.1585

- Stop 1.1503

- Take profit at 1.1833

The reason for the trade is largely fundamental:

As per Eamonnn, the bank citing expectations for an SNB floor and European Central Bank normalisation for their long EUR/CHF recommendation.

That trade is in the money now. The price is up at 1.1617 currently. So it is off to a good start.

We know there fundamental reason. What are the technicals saying?

Looking at the daily chart, the price rise did take the price back above its 100 day MA at 1.1625. The high reached 1.16388, but the price is back below that 100 day MA (trading at 1.16173). Technically, the price needs to get and stay above that MA line to give more upside potential.

Drilling to the 4-hour chart, there is also some disappointment from the earlier rally.

Looking at the 200 bar MA (green line in the chart below), the price was above that MA line earlier today (at 1.16187 now). The price is back below that MA line.

Like the 100 day MA, break and fail, the 200 bar MA on the 4-hour has a similar break and fail.

The good news for the trade, is they got in at a good level and are in profit. The bad news is the first run up stalled after breaks above MA targets. That does not mean the market cannot reverse and go higher. It just means there is some more work to be done, to turn the bias more to the upside.