North Korea tensions increase. Stocks tumble and CHF is the beneficiary

The tension between the US and No. Korea has been escalated with fury and fire as Trump volleys stern warnings in response to missile launches from No. Korea. The global stock markets are not taking it well with the Dax down-1.5%, the Cac down -1.7%. and the FTSE down -0.80%. IN the pre-market trading in the US, the Dow futures are down -47. The Nasdaq futures are down -43 and the S&P futures are down -11.

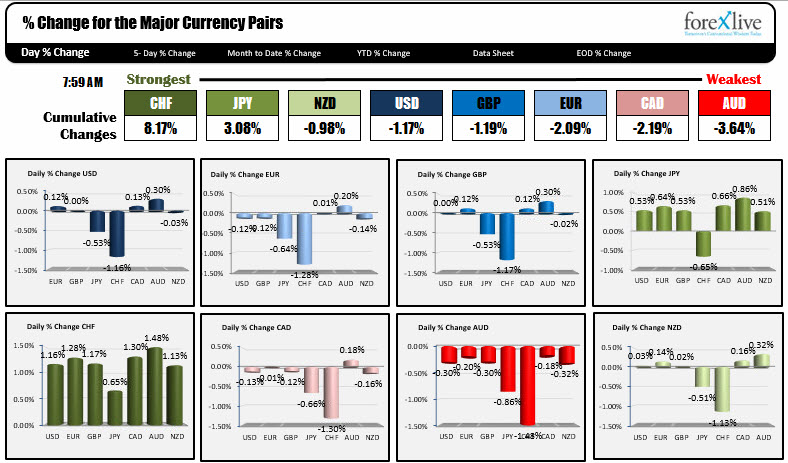

The beneficiary in the currency markets is the CHF. It is lapping the field with the JPY a distant 2nd. The rest of the major currencies are more lower than higher. The AUD is the weakest. Westpac consumer sentiment and home loans were both weaker last night and that helped to get that ball rolling to the downside.

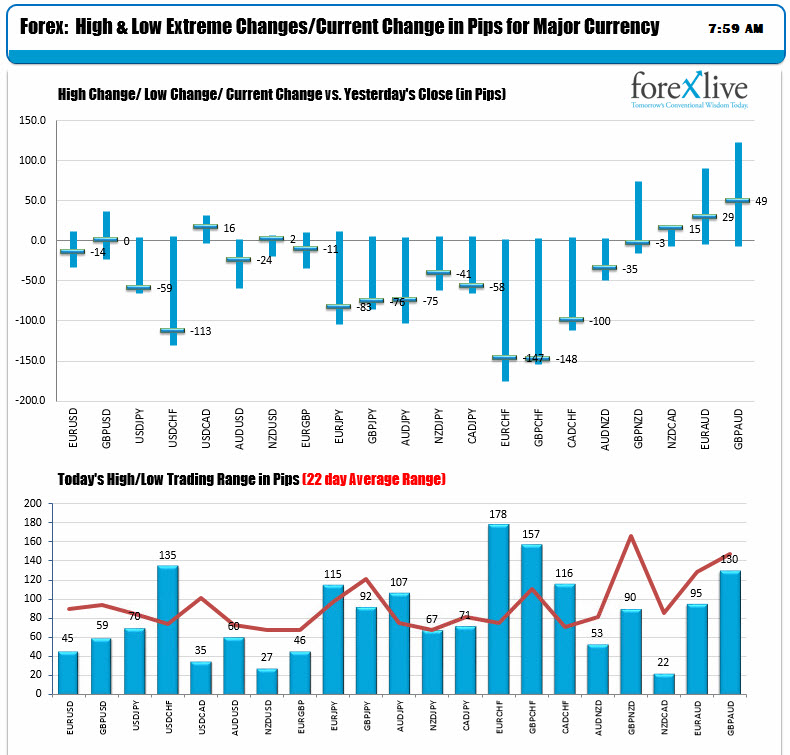

The changes and ranges are showing the CHF pairs are where most of the activity is flowing, but also the JPY crosses are getting action and are trading near low extremes.

In other markets, the snapshot shows:

- Gold a beneficiary of the tension. Spot gold is up $10 to 1270.85. The high reached 1271.60 so far

- WTI crude oil is up $0.37 to $49.53

- The US yields are another flight to safety beneficiary. 2 year is down -3 bp to 1.324%. 5 year is down -3.4 bp t0 1.782%. 10 year is down -3.4 bp to 2,228%, 30 year is down -3 bp to 2.813%.

US nonfarm productivity (2QP) will be released at 8:30 AM ET/1230GMT (est +0.7% vs 0.0% in 1Q). Unit labor costs are est at 1.1% vs 2.2% last month.

Canada will release building permits for June with an estimate of -1.9% vs +8.9% in May also at 8:30 AM ET.

At 10 AM/1400 GMT, the wholesale inventories will be released with a gain of 0.6% est (vs 0.6% last). The trade sales are expected to be unchanged after a -0.5% decline.