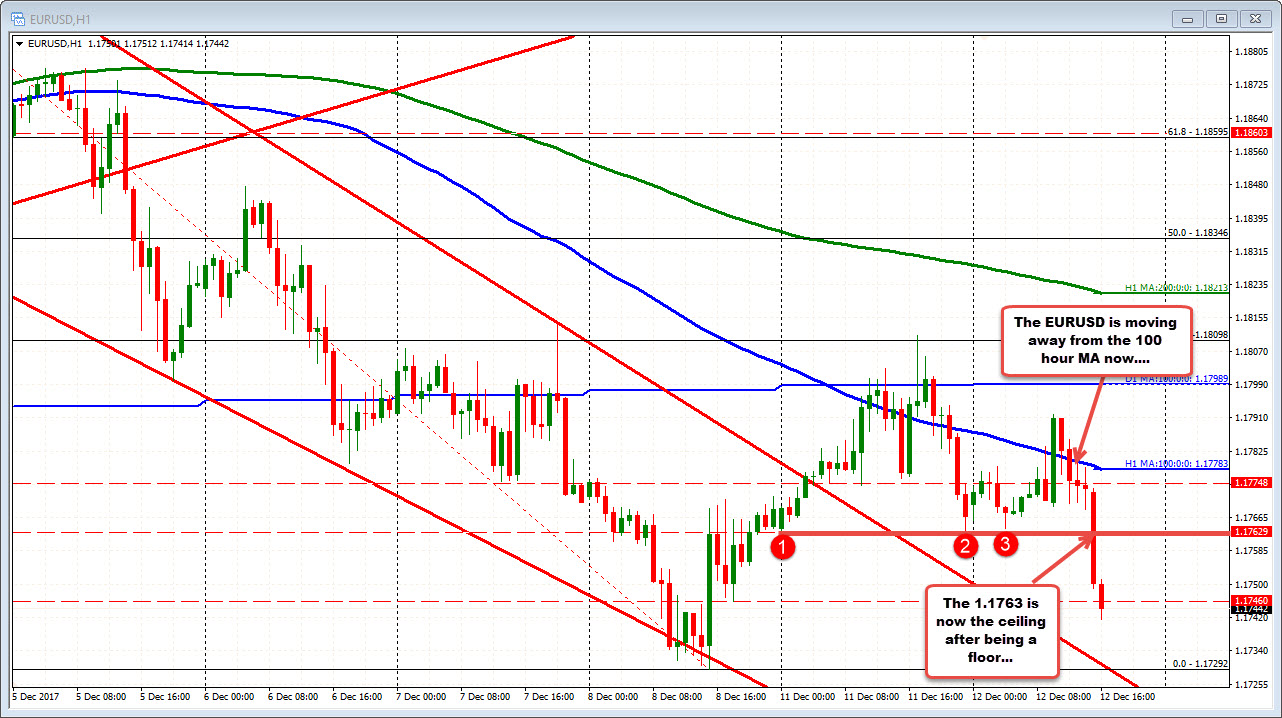

Trades to 1.1750 level.

The EURUSD has extended to the 1.1746 level after the PPI data. Its only about a 30 pips fall from before the data, but in this day of limited movement, it at least is showing some life.

The move lower took out the lows for the week at the 1.1762 area. It was a low at the opening on Monday and also near the end of the trading day. The low today - before the move lower - reached 1.,17637.

So traders might look toward that area (1.1762-64) as a risk defining ceiling now today. Stay below more bearish. The low from last Friday extended to 1.1729 and is a target on future weakness.

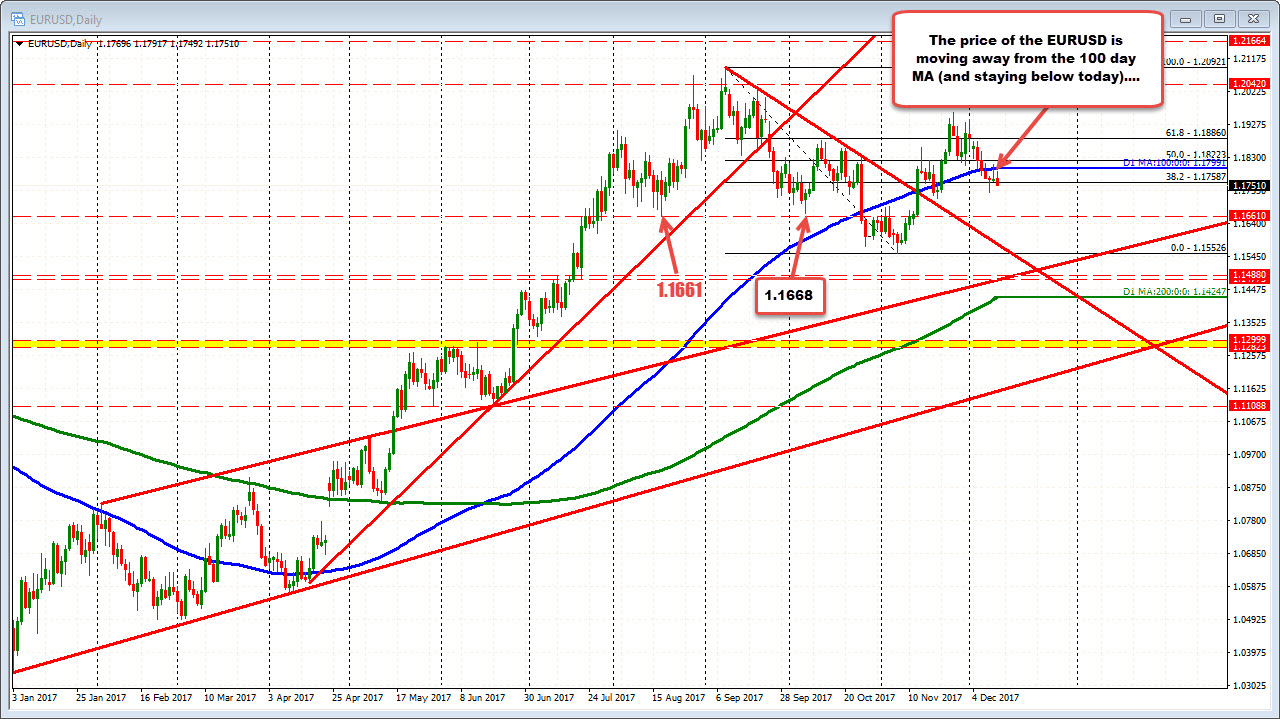

Looking at the daily chart in the pair (see below), yesterday the EURUSD tried to extend back above its 100 day MA at 1.1799 (see blue line in the chart below). The pair could not sustain the momentum above the MA line and closed near the lows.

Today, the high could only reach 1.17917 - short of the 100 day MA line at 1.1799. So bears have been able to keep the advantage from that charts perspective. The low from November 21 comes in at 1.1712. The 1.1661-68 area is home to swing lows from August and October. Those are longer targets going forward. Be aware.

The Fed and the ECB will announce rate intentions this week. The Fed is expected to hike by 0.25%. That is baked in the cake. The ECB is expected to keep rates unchanged, but comments from Draghi will be eyed for more hawkish clues. The Fed decision is Wednesday at 2 PM ET/1700 GMT. The ECB decision and press conference will be at 7:45 AM ET/ 1245 GMT and 8:30 AM ET/1330 GMT respectively.