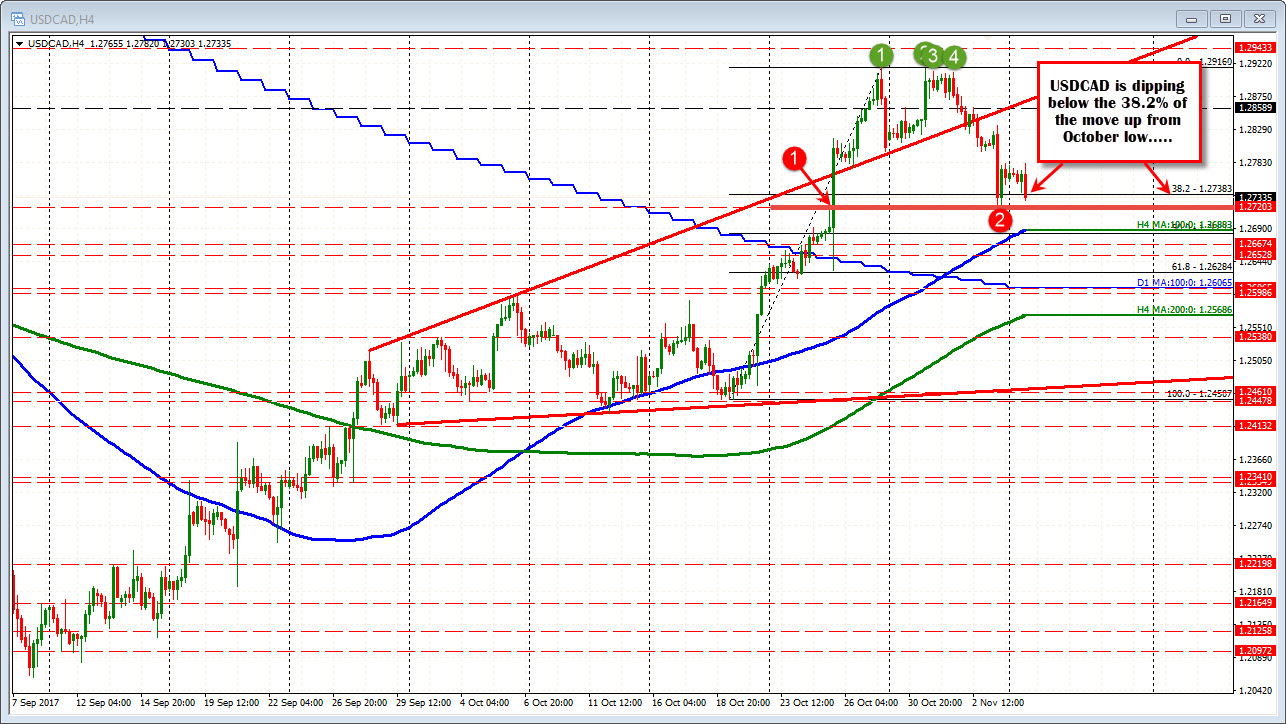

Trades below 38.2% retracement. Approaches Friday lows.

The USDCAD is moving in the direction of a lower dollar - much like the other major currency pairs.

The pair should also be influenced by sharply higher prices in crude oil. WTI crude oil futures are currently up about a $1.50 or 2.63% at $57.10. The high extended to $57.33. Normally a higher price and oil is a benefit to the Canadian dollar. We haven't seen a lot of movement to the upside given the sharp move higher in crude oil of late, but the moves today may be a signal of more interest in the oil vs CAD releationship.

Technically the USDCAD has moved below the 38.2% retracement of the trend move up from the October low. That little comes in at 1.27383. We currently trading at 1.2725.

The pair is also testing the swing lows from Friday's trade that, in at 1.2715 and 1.2719. A swing high from October 25 also stalled at this area (1.2721).

A move below the 1.2715/21 area, would next target the 100 bar moving average of 4-hour chart at 1.2688, and the 50% retracement of the move up from the October low at 1.2686