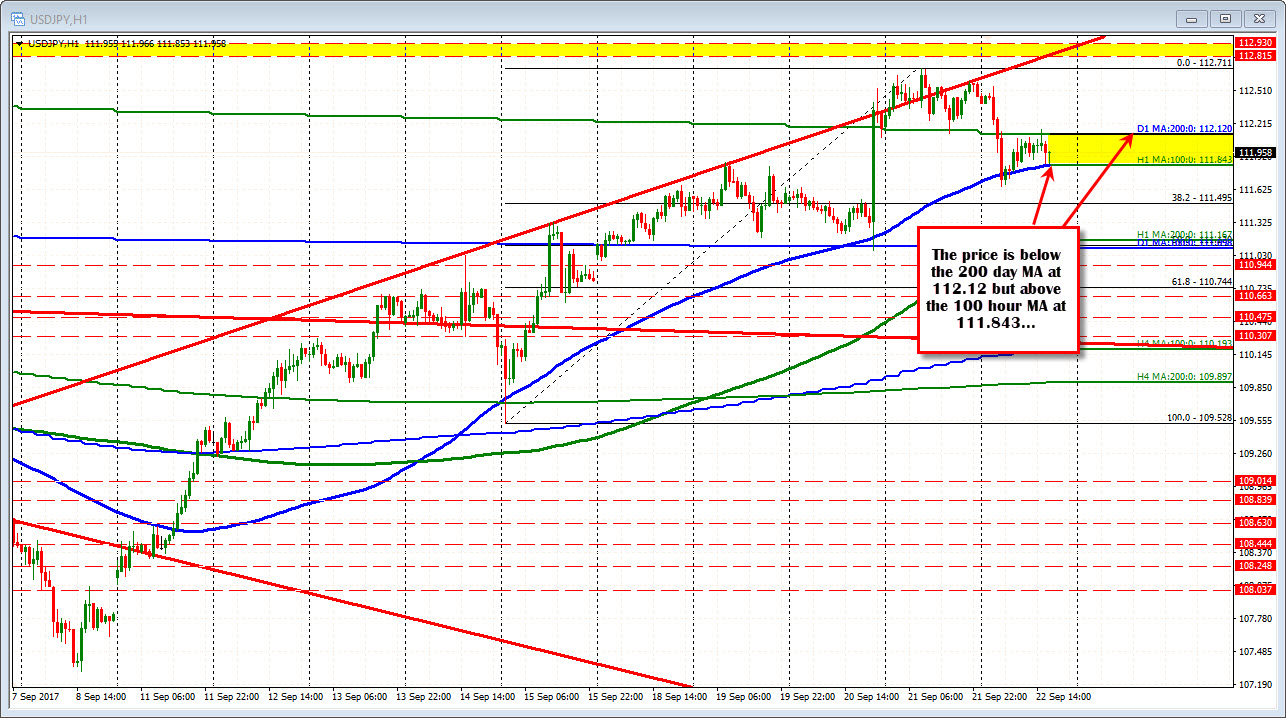

And the support and resistance lines are converging

The USDJPY moved lower in trading today. N. Korea comments pushed the pair lower (the old buy the JPY trade which is confusing since N. Korea has said they would sink Japan).

Technically, the fall took the price back below its 200 day MA at 112.20 today. The hourly price bars in the chart below have all closed below that MA line with a couple small looks above the MA line over the last 14 or so hours. Each of those looks were for a short period of time and did not attract any momentum buying.

On the downside techncally, the 100 hour MA (blue in in the chart above) at 111.843 currently is providing support. There was a close earlier in the day below that MA line, but sellers could not keep the momentum going and buyers took the price back up toward the 100 day MA resistance level. The last two hourly bars have stalled at the MA line.

The market is coiling like a spring between support at the rising 100 hour MA (at 111.843) and resistance at the set for the day 200 day MA (at 112.12). Traders are playing the range so far, but at some point there will be a break and run.

Keep an eye on the interest rates. They are lower on a flight into the safety of the JPY. The 10 year yield is down -2.8 bps at 2.2481%.