Range is small at 43 pips

The Monday range in the USDJPY is only 43 pips. The 22-day average is 75 pips (about a month of trading). We are off to a slow week in trading.

Technically, the pair stalled at the highs near a ceiling area and the 100 bar MA on the 4-hour chart. That ceiling comes in at 112.815 to 112. 93 (see red circles and yellow area). The MA is between those levels at 112.846. The high price could only get to 112.765. The lid remains on the pair. Stay below keeps the corrective bears are more in control.

The problem with the bearish call is that the low stalled ahead of the 38.2% retracement at 112.31. The low reached 112.33. On Friday, the lows did move below the retracement level but only to a low price of 112.25. The momentum lower faded.

There is work to do for the bears if the corrective move lower is to continue but the key ceiling level is in place above.

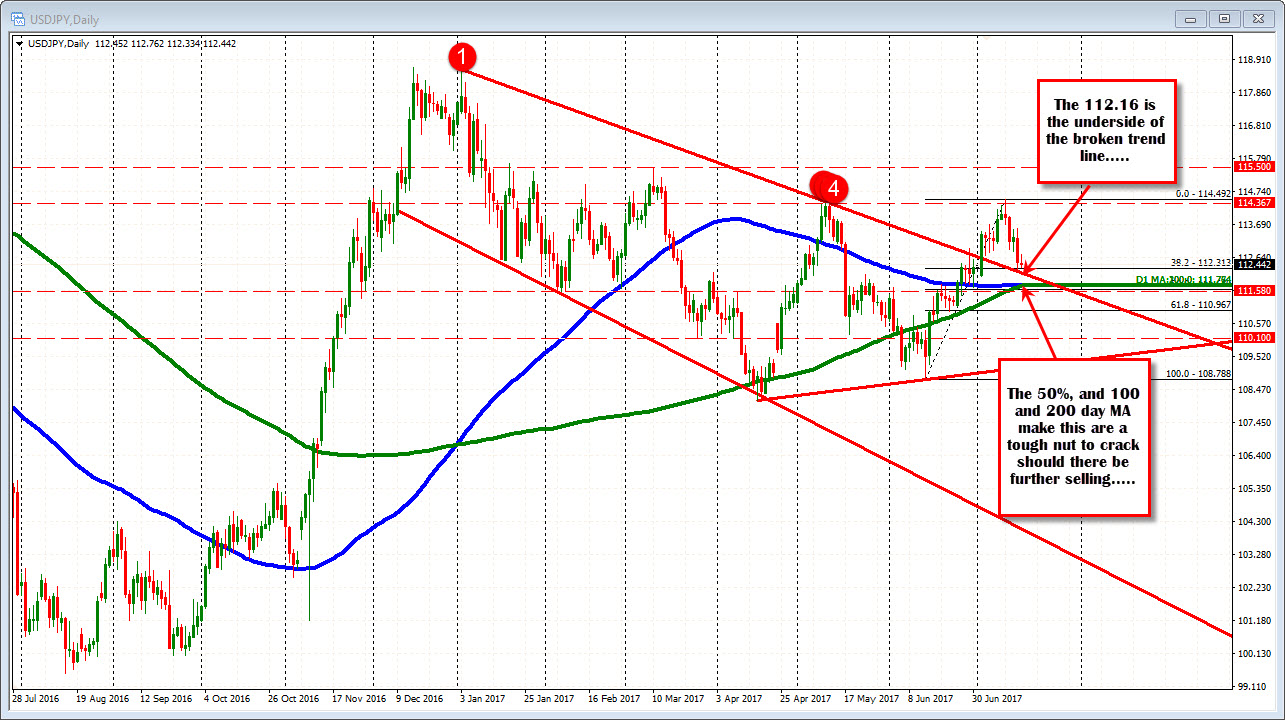

If there is a move below the support at the 112.31, the corrective move should extend lower. Looking at the daily chart, the underside of a broken trend line comes in at 112.16. Below that and the 112.00 natural support level is the next stop. A move below that and the door opens up for a move toward the next key support area defined by the 50% retracement, 200 bar MA on the 4-hour and the 100/200 day MAs (see daily and hourly charts. All those levels are centered between 111.637 and 111.77. That will be a tough nut to crack if tested. Keep the level in mind.

PS the last 4 hours of trading have been below the close from Friday at 112.50. Stay below is more bearish intraday.