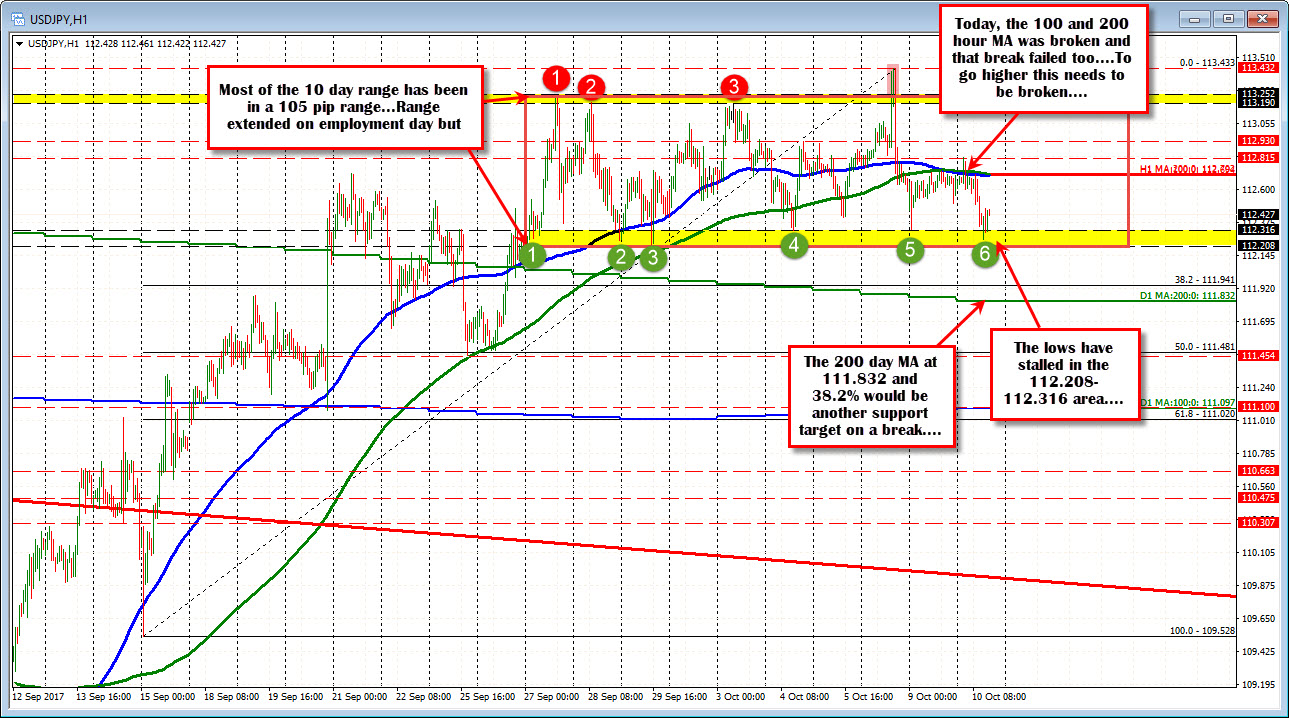

Swing low area at 112.208-316 is the floor. The 100 and 200 hour MA are the ceiling.

The USDJPY on US employment day, extended a 105 pip trading range by about 18 pips and failed. The price moved back in the range defined by 112.208 on the downside and 113.252 on the topside.

In between that range,sits the 100 and 200 hour MA (blue and green lines). The price fell below those MA lines on Friday and stayed below them yesterday.

Today, the price tried to see what trading was like above those MA levels in the Asian session. The momentum did not last too long. The price moved back below the MA lines at 112.70 and wandered lower. The fall stalled in the lower floor boundary between 112.208 and 112.316. We trade just above that area at 112.38 currently.

So the ranges are set.

- The wide range goes from 112.208 to 113.252. Get below or above the extremes and look for momentum in the direction of the break.

- The more narrow range has the 100 and 200 hour MAs as the lower ceiling (and the same lower floor). That comes in at 112.70 above (at the MAs) and 112.208 below). Stay below the MAs or break below the floor, and the bears are more in control. Move above the MAs, and the price should extend higher on the more bullish bias.

Could there be failed breaks?

Yes. We saw one on Friday and another one today. If you buy on a break above and the price does not go higher, get out on the failure (you can even go with the failed break). The same is true should there be a downside break. However, a break does imply more bearish (below) or more bullish (above) at least initially. You have to trust the break.

At some point the 10 day 105 pip (mostly) range will be in the rear view mirror. Until then, trades will trade the levels (or even the failed breaks). Follow the market.

Stocks are getting set to open. There should be some early gains. US rates (a barometer for the dollar) is showing lower yields but only by less than a basis point.