Stocks giving up gains. Rates give up some gains.

The USDJPY has turned around and is seeing more selling.

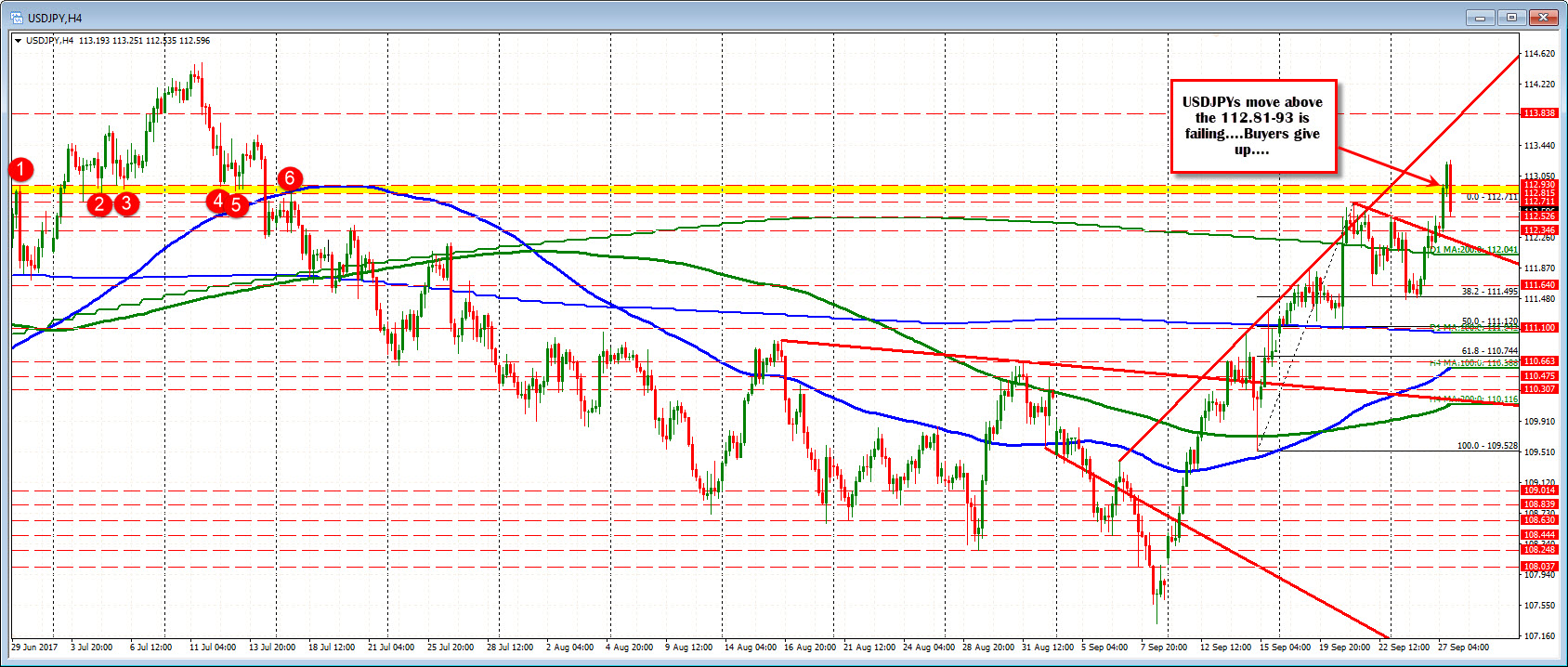

The pair moved above the 112.815-93 level earlier today. That level was the swing levels going back to June and July 2017. A key break if the price could stay above (see prior post)

The price could not stay above. The price has moved lower.

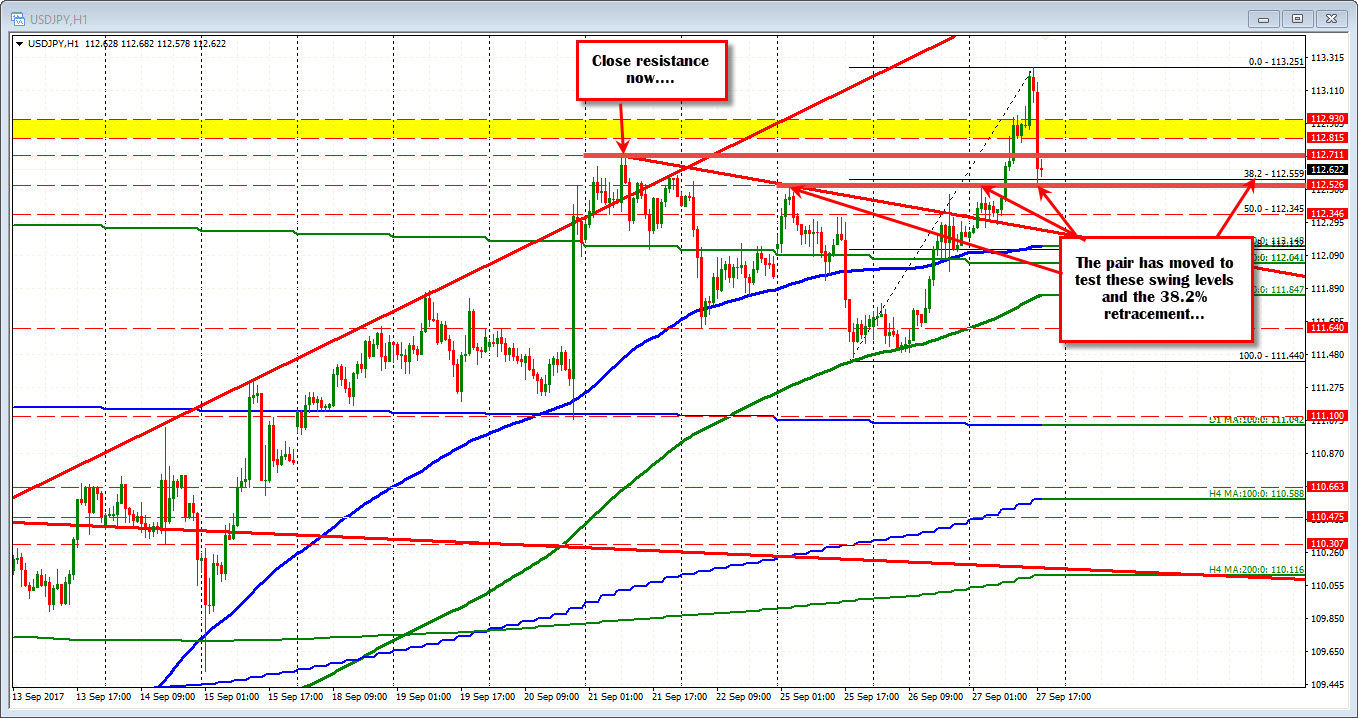

Drilling to the hourly chart, the low has moved to test swing highs from September 25 and from earlier today at the 112.52 area. The 38.2% of the move up from the Monday low comes in at 112.559. There is a little pause here. Get below more bearish.

A correction higher now will watch the 112.71 level. That was the high from last week. Stay below and we can expect more downside potential. Move above and the yellow are at 112.815-93 will be retested and the market can decide against that key level again.

There is a report the tax cuts are not retroactive. That could be an impact.

Stock are off the highs. US yields are lower with the 5 year up 4 bp now at 2.2925% vs 2.3121% high yield. Gold is still down by -$6.60 but it was down about $11-$12 at the lows.