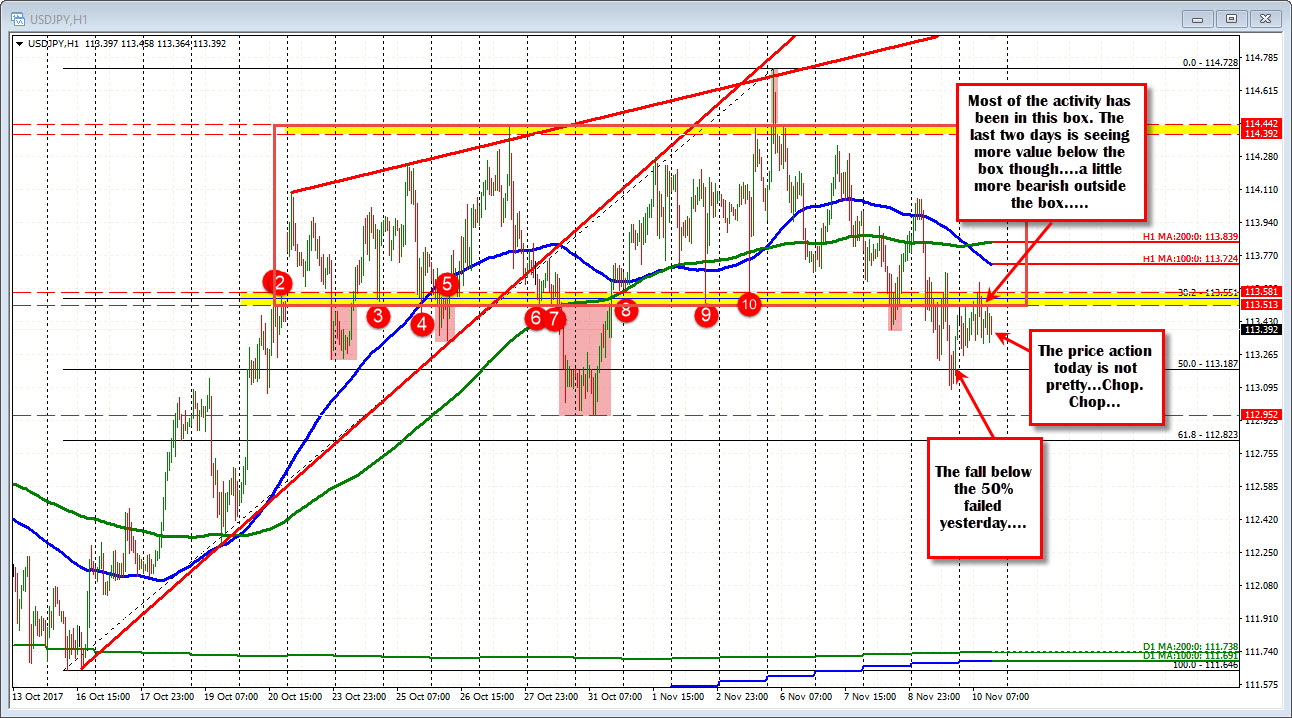

Lots of chop

The USDJPY is "random walking" today in a choppy up-and-down motion.

The price high did move above a swing area that has had a number of swing levels. That area is also the low of a box that trading has mostly been centered. Stay outside the box and it is more bearish.

Anyway, the move "into the box" and above the lower yellow area at 113.51-58 failed.

We are staying below that area (from 113.51-58) giving more of a bearish look to the choppy action.

Having said that the downside is not exactly running. We also remain above the 50% at 113.187. Yesterday that level was broken and failed. It is a target for sellers to get to and through.

So who gets the nod?

I give more of the technical nod to the shorts as long as we remain outside the box and below the 113.51-58 area.

PS Of note today is the US yields are higher in trading today with 10 year up 3.7 bps at 2.3788%. Earlier this week the note was down testing the 200 day MA at 2.31%. That test was successful for now at least. Higher yields tend to support the USDJPY, but not so much today.