Up about 13 points or 0.06%

The Nikkei 225 is going for the 17th straight day of gains. The index is up about 13 points to 21817.

However the gains were much higher at 21921.36. The low today has reached 21808.81 so far.

The move higher was helped by a higher close in the US markets with Caterpillar and 3M leading the charge in the Dow (up 167.80 points or 0.72%). The S&P added 4.15 points or up 0.16%. The Nasdaq advanced 11.60 points or 0.18%.

Looking at monthly chart of the the Nikkei index, the price this month has raced above the 2015 high at 20946. The high today is the highest high since July 1996. The next upside target comes in at 22750.70. That is the high from June 1996. Just above that is the 50% retracement of the move down from the 1989 high at 22986.03. It has been a long time since seeing these levels in the bellweather index for Japan.

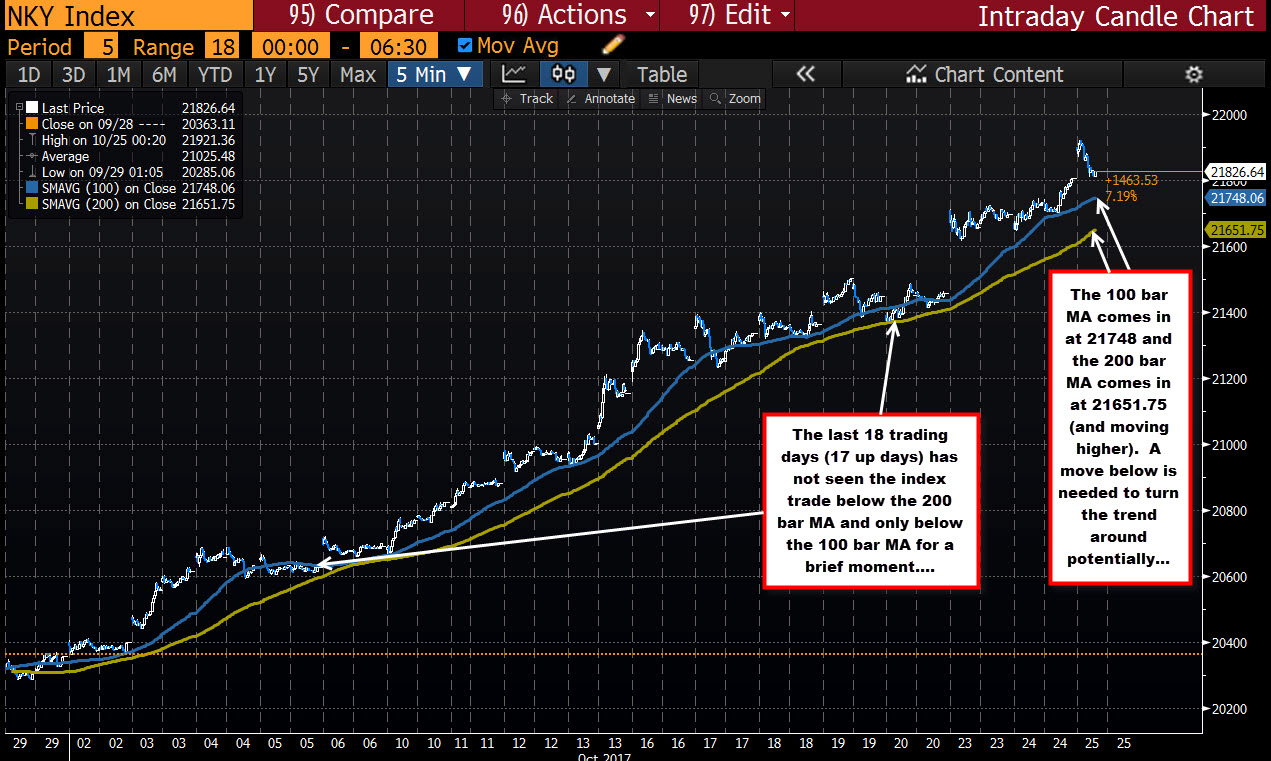

Drilling to the last 18 trading days (going for 17 up days), the trend has been using the 100 and 200 bar MAs (blue and green lines in the chart below) as support. There have only been a couple dips below the 100 bar MA (blue line) but each of those falls ending up finding support buyers against the 200 bar MA (green line). Not surprised as trends trend and they follow the technicals.

The 100 bar MA is at 21748 and moving higher. The 200 bar MA is at 21651 and moving higher. A move below each turns the bias a little more bearish (or at least a little less bullish). Until then the buyers remain in control.

As I type the Nikkei has gone into the red at -10.74 points.