The USD is mixed. Draghi, stocks and US data awaited.

The AUD is the strongest. The CHF is the weakest as North American traders enter for the day. The market is somewhat quiet and following the flows of the stocks which are seeing a rebound on the back of some better earnings after the close (Microsoft, Tesla) and this morning (Twitter). That has helped the AUD rebound and sent the CHF lower (risk off).

The market is also awaiting Draghi at 8:30 AM ET/1230. Also at 8:30 AM ET will be:

- Durable goods for September. expected -1.5% versus 4.4% last month. Ex-transportation expected +0.4% versus 0.0% last month

- initial jobless claims expected 215K versus 210K

- advanced goods trade balance for September (US) expected $-75.1 billion vs $-75.5 billion

- US wholesale inventories expected 0.5% versus 1.0% last month

- ECB Draghi press conference after the ECB rates unchanged as expected

The ranges and changes today show the relatively tame price action. Even the GBPUSD only has a 41 pip range today. The pattern has been for it to lead the volatility range on Brexit news. The EURUSD only have 29 pip range. The USDJPY is biggest mover with a 55 pip trading range. It is higher on the back of the equity rebound

In other markets:

- spot gold is down $2.65 or -0.21% at 1231.17

- WTI crude oil futures are trading up $.24 or 0.36% at $67.05

US stock futures are implying higher openings for the major indices after the sharp declines yesterday. Earnings beats are helping the tone today.

- S&P futures imply a 28 point gain

- NASDAQ futures imply a 135 point gain

- Dow industrial average futures imply a 233 point gain

European shares have also rebounded and are higher:

- German DAX, +0.3%

- France's CAC, +1.2%

- UK's FTSE, unchanged

- Spain's Ibex, +0.9%

- Italy's FTSE MIB, +1.6%

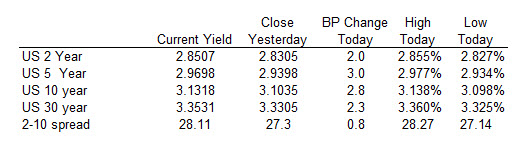

Yields in the US are higher, also rebounding from the short in trading yesterday on back of flight into safety:

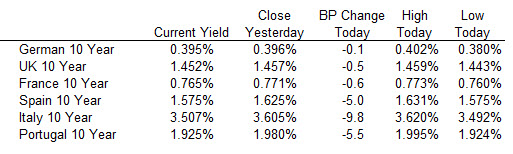

European benchmark 10 year yields are lower. Italy - which has been volatilite as the EU and Italy volley back and forth - or lower by nearly 10 basis points today.