The USD is finding a bid on safe haven flows

The US stock futures point to more selling today after the plunge yesterday. The futures are projecting that the S&P is to open -46 points. The Nasdaq is schedule to open down about -78 points and the Dow down about -562 points. How does that shake out in the forex markets.

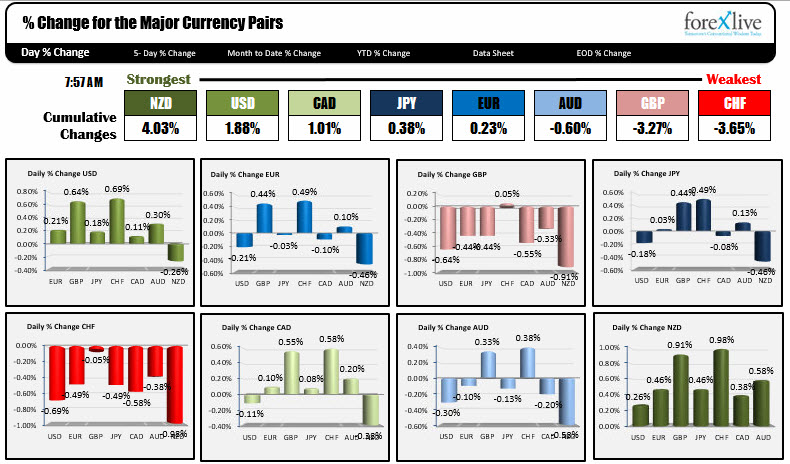

The snapshot of the changes of the major currency pairs is showing the NZD is the strongest, while the CHF is the weakest. No safe haven flows in the CHF. The USD is rising with some safe haven flows. The GBP is also under pressure. The EURUSD and the GBPUSD are trading at even lower levels now as the flows into the USD continue (USDJPY is higher too).

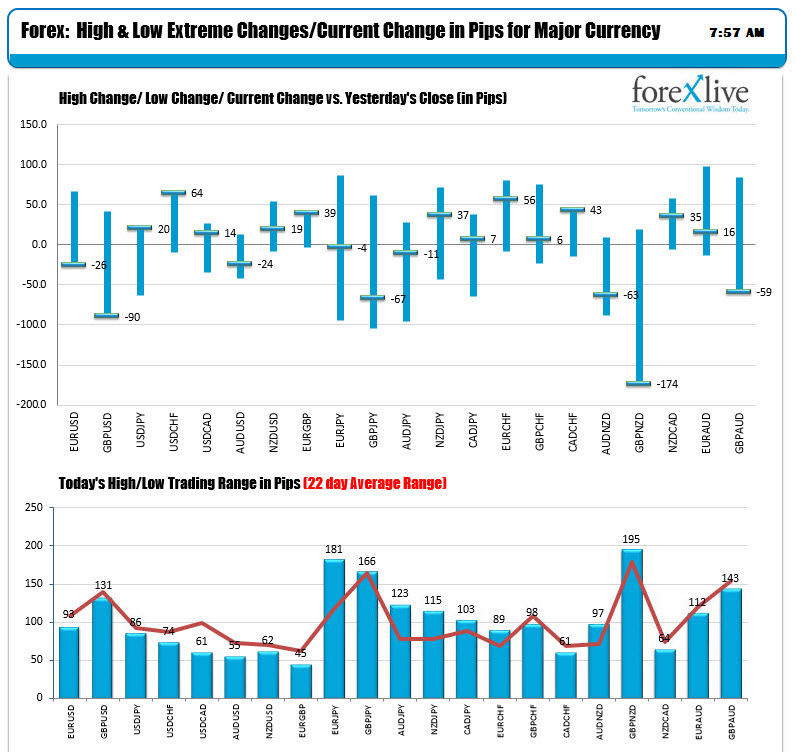

Looking at the ranges and changes is showing the move into the USD. The EURUSD was higher. It is now at the low. The same price action is seen in the GBPUSD, USDJPY, USDCHF, USDCAD. The NZDUSD is the only pair showing a weaker USD.

As for the ranges as expressed by the 22 day average trading range, there is lows of action in the JPY crosses. They saw a rebound but are heading back lower on the continuation of the stock weakness. The ranges vs the USD show the most action in the GBPUSD.

The markets will remain volatile in the NY session. The flows should be influenced by what other markets are doing and flows. That should make for whippy markets. But the bias seems to be into the USD on equity weakness (and visa versa) but that is not always guaranteed in these times from minute to minute. So be careful.

A snapshot of other markets is showing:

- Spot gold down -$5 or -0.36% at $1335

- WTI crude oil is down $.81 or -1.25% at $63.35

- Bitcoin on Coinbase is trading down $153 at $6925

- US treasury yields are higher. There is not the flight into the safety that we saw yesterday: two-year 2.048%, up 2.4 basis points. Five-year 2.462%, up 2.5 basis points. 10 year 2.730%, up 2.4 basis points. 30 year 3.025%, up 1.9 basis points.

- In Europe, stocks are lower. German DAX -2.29%. France's CAC -2.73%. UK's FTSE down -2%. Spain's Ibex, -3.06%. Italy's FTSE MIB, -2.51%

- 10 year yields in Europe are mixed: German 0.684%, -5.2 basis points. France 0.949%, -4.7 basis points. UK 1.510%, is 4.8 basis points. Spain 1.435%, -2.4 basis points. Italy 2.003%, -2.2 basis points. Portugal 2.104%, +5.9 basis points