The US is mostly higher ahead of the Fed

As North American traders enter for the day, the NZD is the strongest - barely beating out the JPY and USD, and the CHF is the weakest in what is a uninspired rangy trading market. Of course, in what will be a cliche today, "the market is awaiting the Fed decision, where they are largely expected to hike by 0.25 basis points." There is no question as to the Fed decision but the details of December and 2019 will be the focus after the 2 PM ET decision and presser (at 2:30 PM ET). There will be New Homes sales data released at 10 AM ET/1400 GMT. The DOE inventory data will be released at 10:30 AM ET/1430 GMT. Private data showed a build of 2900K. The expectations on Bloomberg call for a -1500K draw down.

The trading ranges are well below the 22 day averages. The NZD being the exception as the pair spiked in the Asian session on the back of improved business confidence, only to come right back down to near unchanged vs the USD. With the "market awaiting the Fed decision", it might take a Trump, Brexit or Nafta bomb to get the price action going before then (and there is the possibility the hike itself might be met with silence too since it is so expected).

In other markets:

- Spot gold is down -$3.75 or -0.31% at $1197.55

- WTI crude oil is down -$0.52 or -0.72% at $71.75

- Bitcoin on Coinbase is up $120 at $6504 after the tumble yesterday. The digital currency retests the broken 200 hour MA at $6522

In the pre-market US stocks, futures are implying a higher opening:

- Dow is up 20 points

- S&P is up about 4 points

- Nasdaq is up about 13 points

In Europe, major indices are mixed:

- German Dax is down -0.2%

- France's CAC is up 0.3%

- UK FTSE is down -0.1%

- Spain's Ibex is up 0.24%

- Italy's FTSE MIB is down -0.28%

US yields are lower marginally with a continued flattening of the yield curve (2-10 flatter by 0.7 bps)

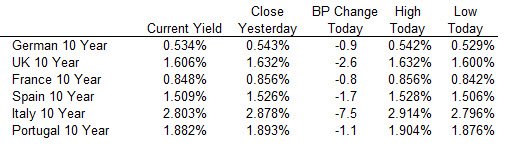

The 10 year benchmark yields in Europe are also mostly lower with Italian volatility continuing: