The pound's downfall is what led to the dollar's outperformance

As mentioned earlier, the dollar may be leading the charge after EUR/USD broke below 1.1300 but it's the pound that is the number one driver in the currencies market today. The weakness in the quid due to Brexit woes led to a fall in the currency, which in turn dragged down the euro (alongside Italian budget worries), and that has led to the overall price action that we're seeing here.

The dollar is in the driver's seat as we're seeing solid gains across the board but it's mostly the break of the 1.1300 handle in EUR/USD that is driving sentiment in that regard. But just another reminder, this all comes during a session that is poised to see thin liquidity and market jumps can be a little hard to digest.

As preluded earlier in the day before the break:

Either way, expect a break below 1.1300 in EUR/USD to give the dollar added momentum across the board and the greenback will surge in holiday-thin trading as a result, but for added confirmation of a break, we have to rely on tomorrow's price action for further clues. Though on the flip side, the thin liquidity session may yet prove to be the opportune moment for sellers to finally drive a move lower that will continue for the sessions to come.

I'm not complaining about opportunities on a day like this but I won't read too much into price action until we get a real glimpse of what the breaks today mean tomorrow.

For the pound, I would say we're very much headed back towards the year's lows again and I don't expect the quid to see too much recovery even if prices retrace tomorrow. GBP/USD now looks headed towards a test of the September low @ 1.2786.

In short, I don't see anything other than a Brexit deal being able to save the pound at this point. And if a November Brexit summit is officially off the table, expect the pound to continue to sink as market fear of a no-deal Brexit continues to grow.

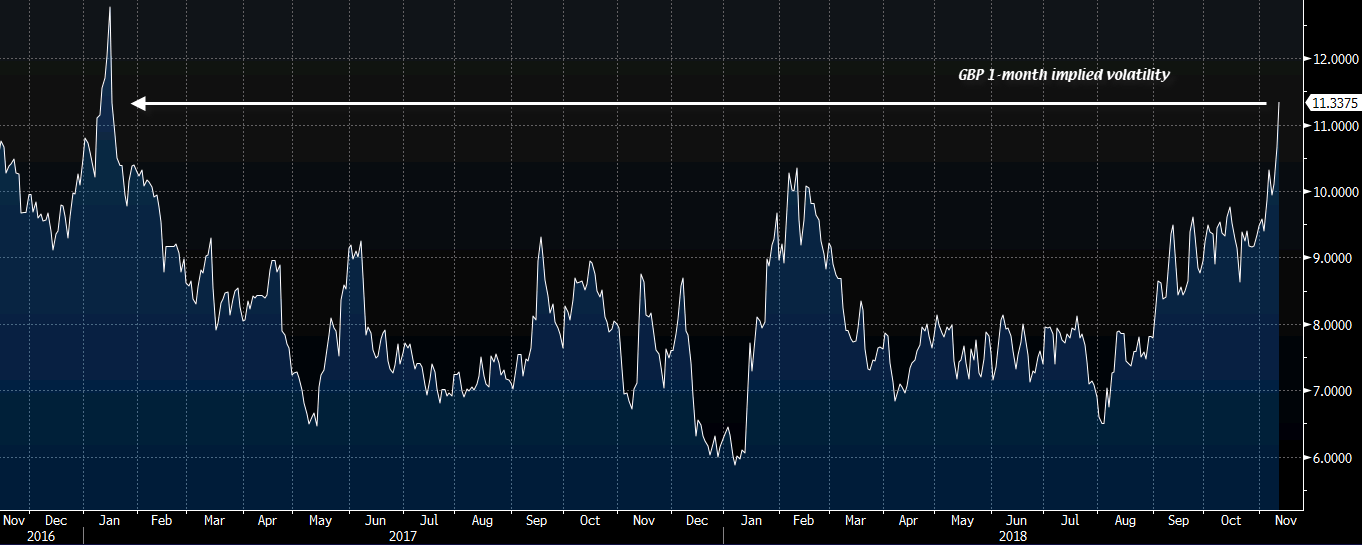

If you want an idea of why the pound is feeling jittery and how it's driving price across other currencies today, this chart basically tells the story. 1-month implied volatility in sterling options has risen today to near two-year highs and that basically shows you how much traders are starting to fear a no-deal Brexit.

Taking that as an indication, the pound looks set for further downside as long as there is no optimistic news that we will see a deal come about this month or in December.