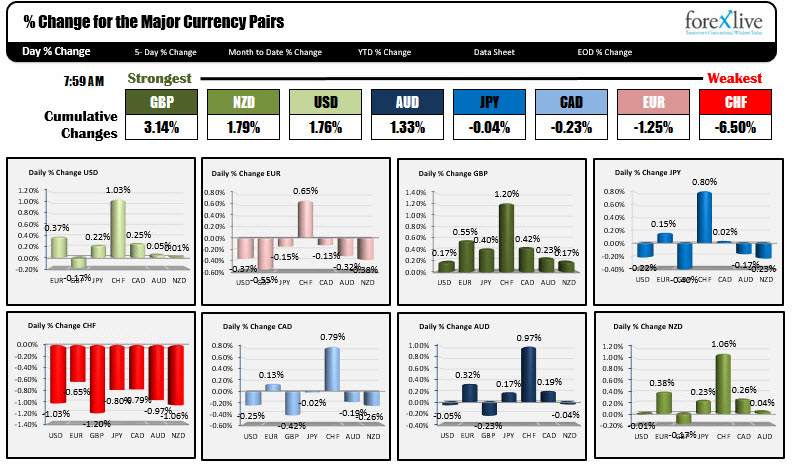

The GBP is the strongest. The CHF is the weakest.

As North American traders enter for the day, the GBP is the strongest while the CHF is the weakest. The CHF was a "tale of two cities" or two central banks (or so it seems) yesterday.

The early hours were dominated by speculation the SNB was selling the CHF (higher USDCHF). The price moved to the 100 bar MA on the 4-hour chart and stalled. Later the Fed did its magic on the USDCHF (and all currencies) and the pair retraced all of its earlier gains down to the 100 hour MA at 0.9494 (the low touched 0.9490 today).

The pair is now above the highs from yesterday as SNB and hedge fund buying (see Mike's post). The USD today is higher against all currencies with the exception of the GBP today.

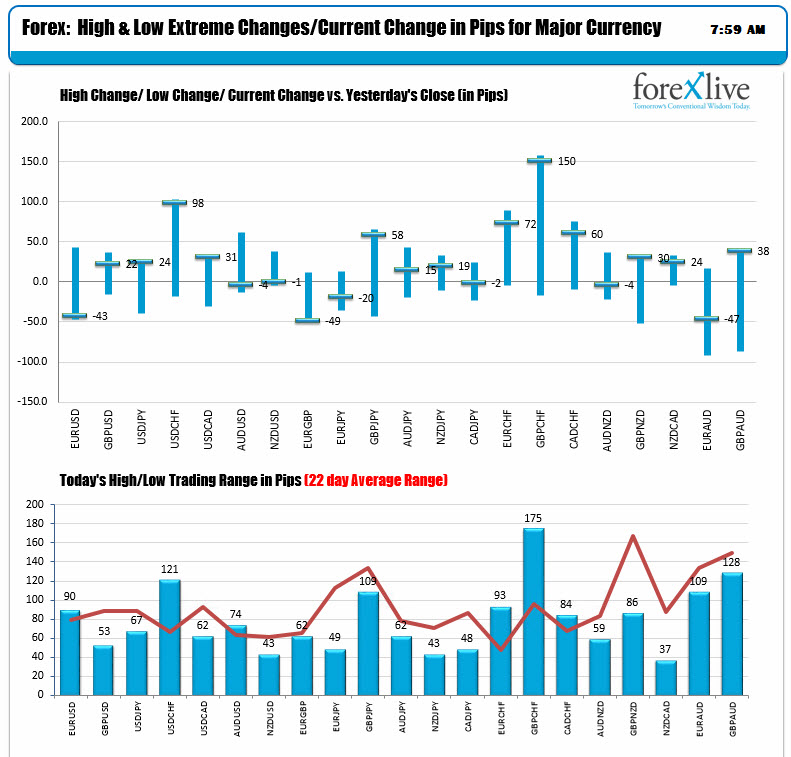

The volatility is pretty good in the market. The EURUSD has had an up and down day. It trades at the day's lows as NA traders enter. The USDCHF has a 121 pip range. That is well above its 22 day average range of 65 pips (trending). GBPCHF and EURCHF are also on tear higher.

In other markets:

- Spot gold is up 2.92 or 0.24% to 1263.60

- WTI crude is dow -0.29 or -0.64% to $48.43

- US yields area higher. 2 year is really unchanged at 1.355%. 5 year is up 1.5 bp to 1.842%. 10 year is up 1.2 bp to 2.299%. 30 year is up 2.6 bp to 2.9179%

- US stocks are higher as earning continue to do better. S&P futures are up 5 point. Nasdaq futures are up 43 points. Dow futures are up 20 points.