Canada and US back from Monday holidays

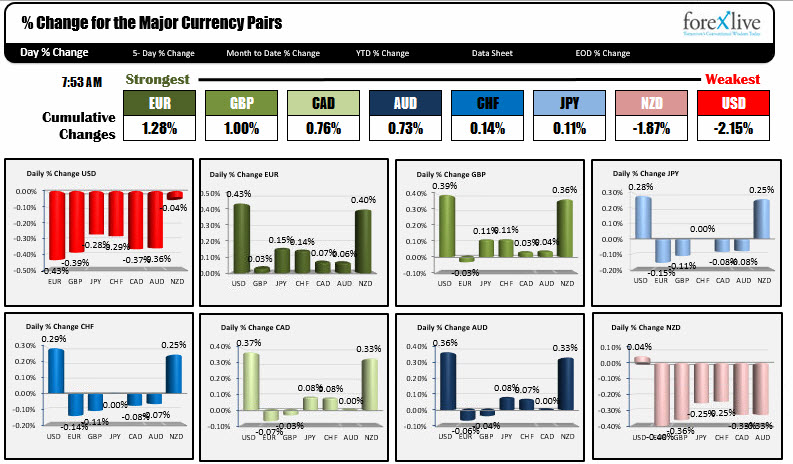

The trading desks are full staff today after the Monday holiday's in Canada and US and the EUR is the strongest, while the USD is the weakest.

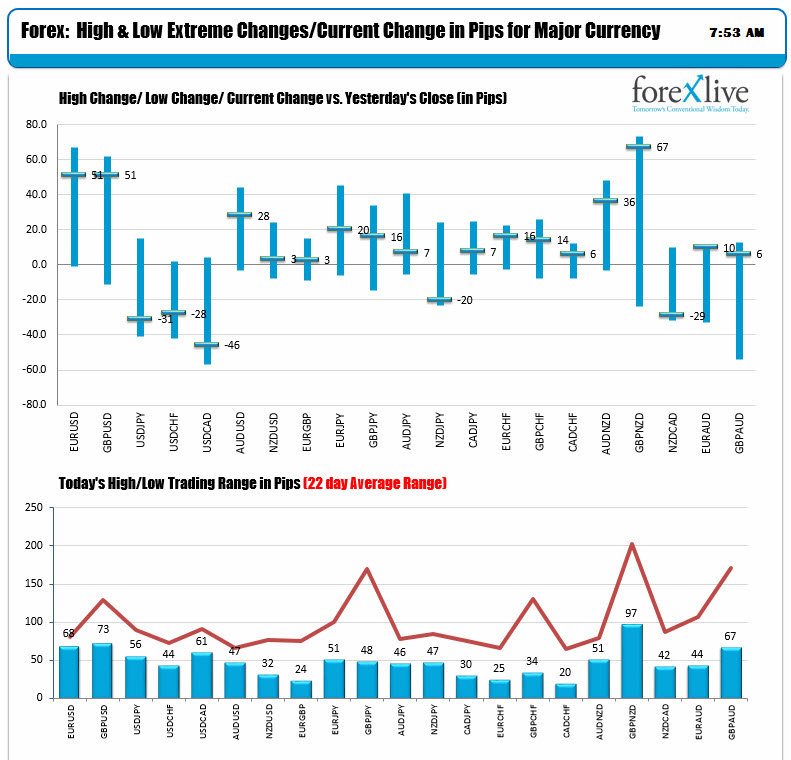

The volatility is not all that great. The ranges (lower chart below) are all below the 22 day averages (red line in the lower chart). The dollar is trading near the lower levels vs the other currencies (a little off the extremes). The direction is lower for the greenback but can it continue in trading ahead?

In other markets:

- Spot gold is higher on the back of the lower dollar. Spot gold is up $8.63 or 0.66% to 1292.50

- WTI crude oil is up $0.59 and back above $50 at $50.17

- US pre-market stock indices are higher. S&P futures are up 4.0 points. Nasdaq futures are up 12.75. Dow futures ar up 43 points

- US rates are down but by less than 1 bp (the bond market was closed yesterday). 2 year is 1.502%, unchanged. 5 year 1.9495%, down -0.6 bp 10 year 2.3535%, down -0.5 bp. 30 year 2.891%, down -0.2 bp

- European 10 year yields are a smidge higher: Germany 0.45%, up 0.7 bp. France 0.727%, up 1 bp. UK 1.378%, up 2.1 bp. Spain 1.695%, up 1.9 bp. Italy 2.141%, up 2.8 bp.

- European stockss are mixed. German Dax down -0.2%. France Cac down -0.1%. UK FTSE up 0.2%. Spain Ibex down -1.1%. Italy FTSE MIB -0.57%