Bias is tilted to the downside on Bitcoin and Ripple, but there is consolidation going on

The price of bitcoin (on the Bitstamp exchange), is trading lower today after falling and bouncing yesterday.

That fall yesterday, saw the price move below both the 100 and 200 hour MAs (blue and green lines in the chart below) and a trend line connecting lows going back to the end of December on the hourly chart below (red trend line).

The 200 hour and trend line proved to be important on the bounce back correction. Those technical tools stalled the rally (see chart below) and will remain a risk/bias defining level for traders in that cryptocurrency going forward. Stay below is more bearish with the lows from yesterday and today (straddling the $14000 level at $13900 and $14123) as downside targets to get to and through for a more bearish bias.

Taking a broader view of bitcoin on the daily chart below, of note is that the 50 day MA is rising and getting near the price. Normally I stick to the 100 and 200 day MA, but the sharp rise in bitcoin begs the use of something shorter to help define bias.

That 50 day MA (white MA line on the daily chart below) has stalled the fall on the last two dips. It is currently at $13787 and the lows this week did get close but not below.

If there is a break, that would be more bearish. Be aware.

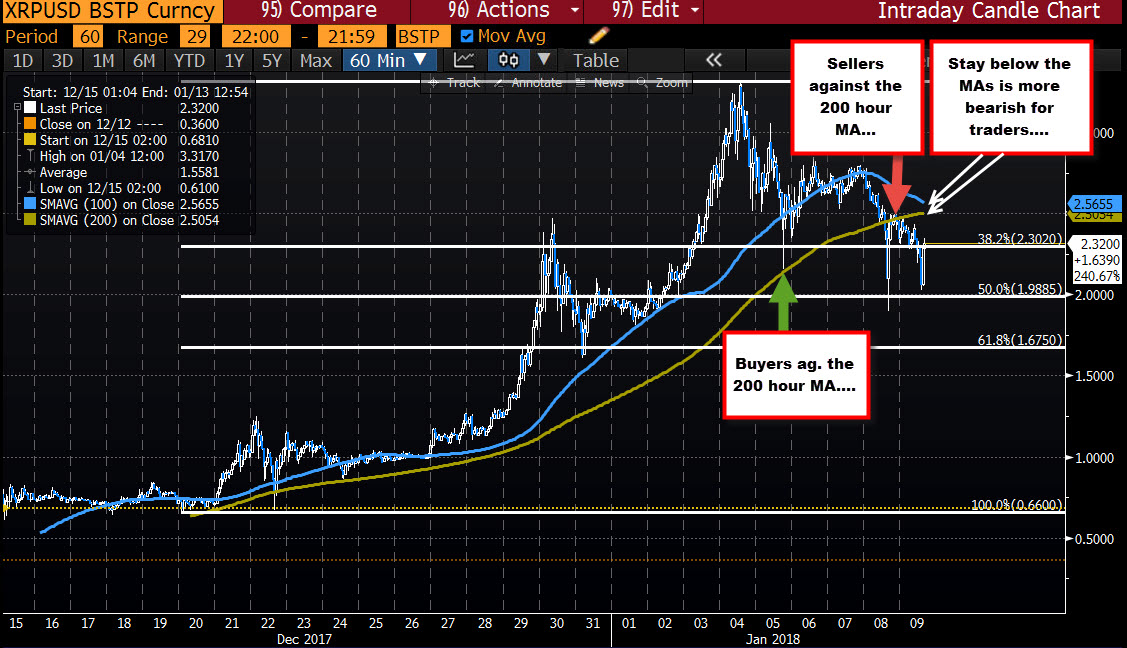

Switching gears and looking at Ripple, recall that that crypto play saw the price spike higher in early January.

The high on January 5th spiked to a high of $3.3171 on January 4th. Since then the price has fallen to a low of $1.9000 yesterday (on bitstamp).

Technically, like bitcoin, the price moved below the 100 and 200 hour MAs yesterday (blue and green lines in the chart below). The corrective move higher yesterday and into today, stalled near the 200 hour MA (currently at $2.5054).

The 100 hour MA (blue line) is moving toward that MA (at $2.5655 currently).

Those two MAs are risk/bias defining levels for Ripple. Stay below is more bearish. Move above, and the bias turns back to the upside (more bullish).

Targets on the downside to get below include the 50% retracement at $1.9885 and the $1.9000 low from yesterday. Today the low stalled ahead of the 50% retracement level. So there is some dip buyers in that area that should be eyed. It could be a bottom.

SUMMARY: The bias in Bitcoin and Ripple is more bearish technically but each are also holding some support levels. For traders, eye the MAs above for bias clues. Move above, and the bias turns more bullish. Stay below and the bias is still more corrective/bearish.