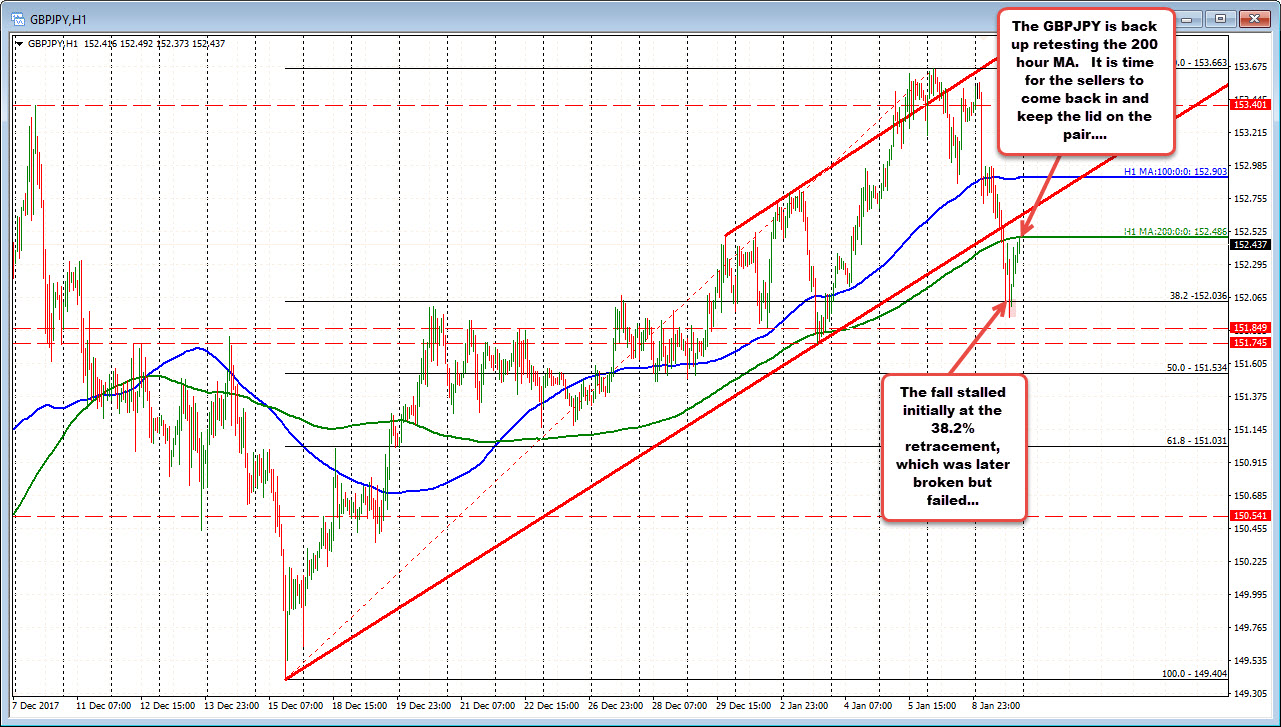

First meaningful trading below the 200 hour MA since December 19

The GBPJPY fell sharply today on the back of the JPY strength and also some GBP weakness.

Technically the price

- stalled ahead of yesterday's high,

- fell below the 100 hour MA ((blue line),

- a trend line connecting lows from Dec 15 and Jan 2, and

- the 200 hour MA (green line in the chart above).

The fall did not stall until extending below the 38.2% at 152.036, but the fall below that retracement level failed and a corrective move was on.

The correction higher has seen the price of the GBPJPY rebound back toward the 200 hour MA (green line) at 152.486.

It is time for the sellers to take back control. I would expect to see sellers here as risk can be defined and limited, and a rotation back lower. Stay below and we could be heading back toward the 152.03 area. Move above and sellers here, will become disenchanted with reaction. The underside of the broken trend line (currently at 152.62) would be the next upside target followed by the 100 hour MA at 152.90.

Time to step up to the plate sellers and keep the lid on the pair below the 200 hour MA.