The US 5-year yield is trading at 4.02% up 10.3 basis points on the day. The high yield reached 4.024%. That extended above the May 2023 high of 3.99% and took the yield to the highest level since March 9.

The low yield today was down at 3.818% after the CPI data, but at the low, the yield tested the rising 200-day moving average of 3.817% and found support against that moving average level. That gave traders the go-ahead to push the yield to the upside.

The move higher comes despite a successful 30-year bond auction where the treasury auctioned off $18 billion with a negative tail of -1.1 basis points. The 3 and 10-year note auctions earlier this week were not as successful.

Looking at the daily chart, the low yield for the year came in at 3.204% back on May 4. The high yield was at 4.376% on March 8. The move to the upside today also comes despite expectations that the Fed will not increase rates tomorrow. Nevertheless, with the Fed funds target at 5.25%, the 5-year yield at 4.02% is still well below that target level. However looking at it with regard to CPI inflation, the year-on-year CPI today reached 4.0% not far from the current 5-year yield. It has been a while since the 5-year yield has been equal to the year-on-year inflation rate.

The move to higher yields is also helped to push the US dollar off low levels (see the hourly chart below).

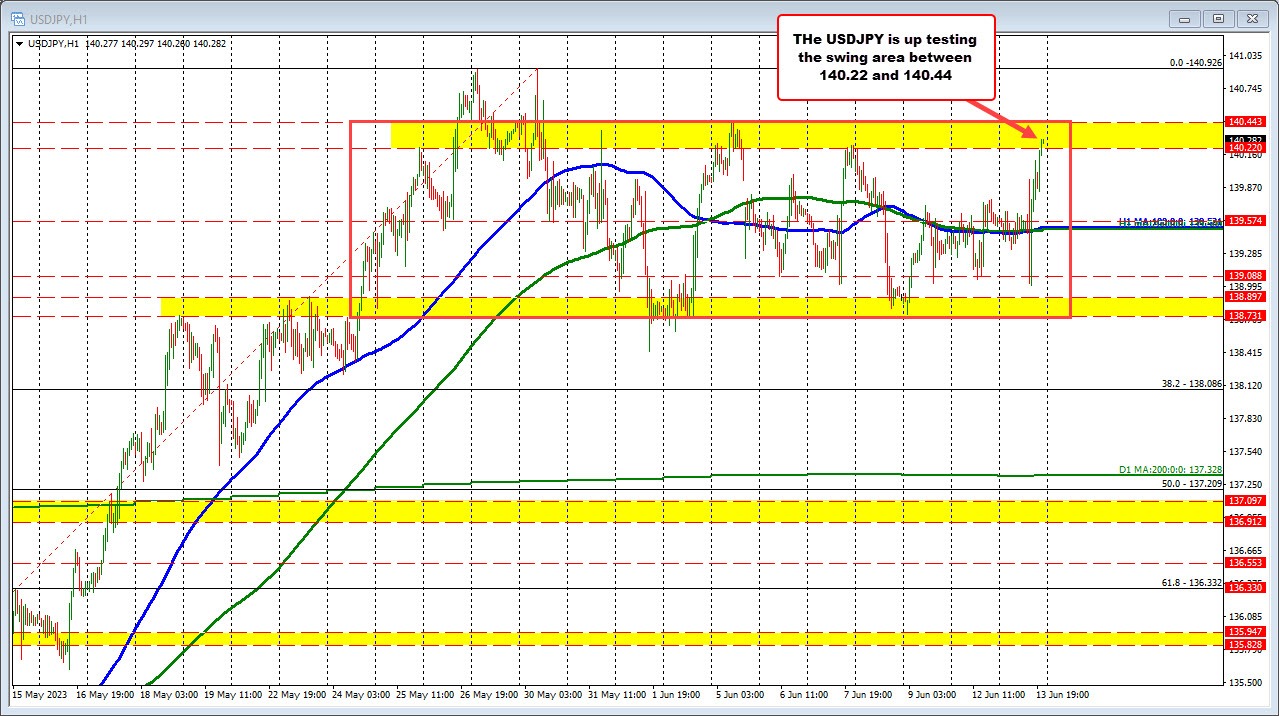

The USDJPY reversed sharply to the upside, and in the process moved back above the 140.00 level. The price is currently testing a swing area between 140.220 and 140.443.

After the CPI, the USDJPY moved lower toward another key swing area between 138.73 and 138.897. The low price came in at a nice round level of 139.00 before bouncing back to the upside.