Break of 1.5000 means time to take the money off the table

I'm now out all of my cable longs from 1.50 down to 1.4610 after this break of 1.50

The level has been a line in the sand for me and the constant fly in the ointment has been the Fed and hikes. We're still two weeks away from the FOMC but I only see further downside from here

It's been a good trade, though not without it's worries. I started going long (too early as usual) around the 1.52's when we came down from the 1.70's, and bought all the way to 1.4610, even when I swore 1.47 would be my tip point. I managed to offload the +1.50's on rallies up towards 1.58 (though too early again) around 1.55/1.56. I'm not going to sit here and possibly watch the rest evaporate.

Adam's post;

This is the definitely the best way to get out of a bad trade

is a timely reminder, not only for bad trades, but for good trades facing bad times. No one ever went skint taking profits

The break of 1.4960 did it for me and what it does now is clear my mind to look at fresh opportunities, rather than sitting here worrying about what to do with the trade

I still feel that a BOE rate hike is a good trade but you have to be guided by what's happening in real time. At one point the BOE were ahead in the rate race and now they're not, and the price reflects that. It's policy divergence at its simplest

What I'm looking for now is for the quid to blowout against the dollar one last time when the Fed hikes. I've said for a while that the this is likely to be the most dovish hike ever and I believe that it will mark a top for the dollar, at least temporarily. There's a whole host of dollar trades in that book but the BOE is still the only other game in town when it comes to raising interest rates, and that's why I was in the trade from the start, not because I'm married to the pound or have a picture of the Queen on my office wall, as some would believe (her picture's actually in the downstairs toilet)

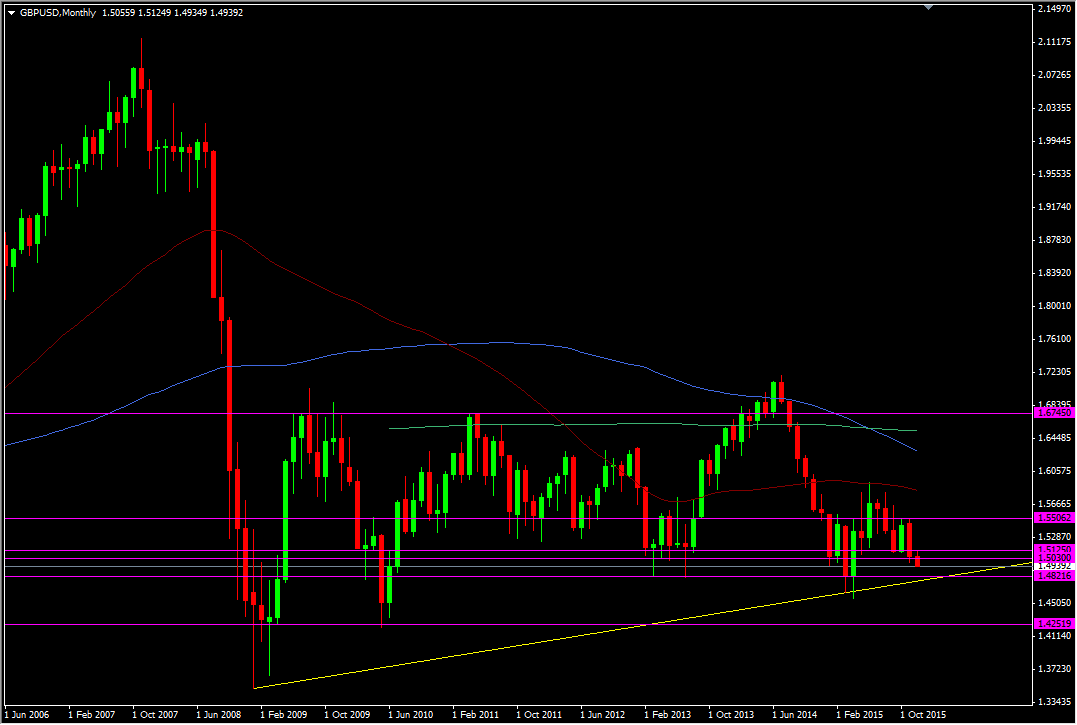

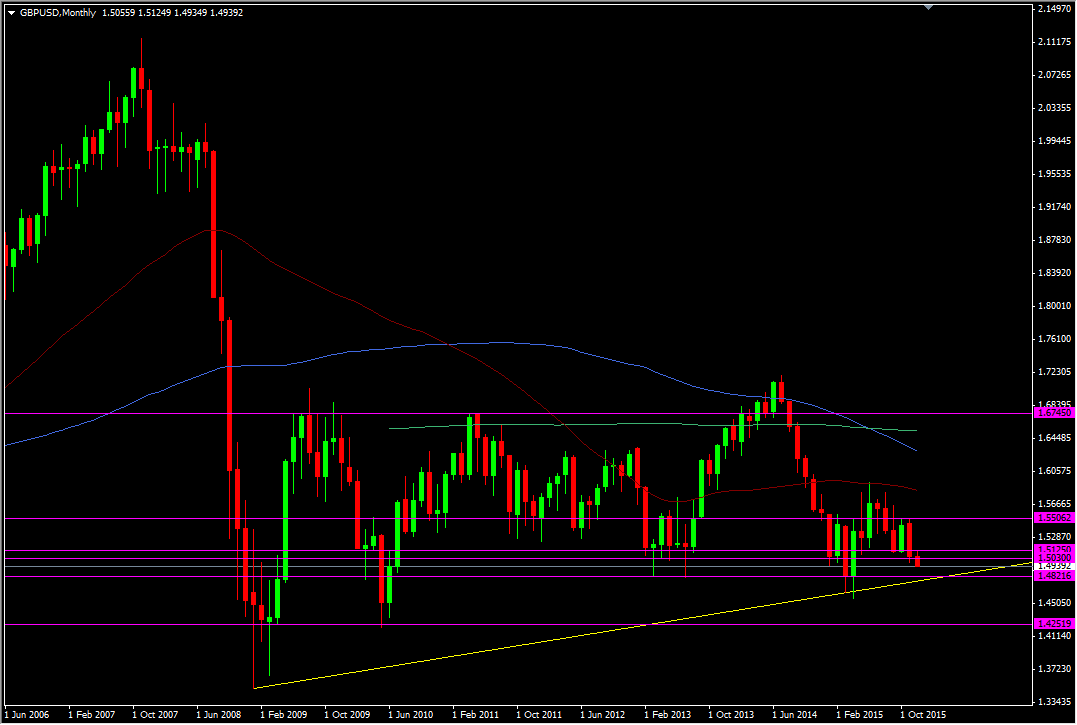

As always, I've gone back to the charts to see what the long term view is and there's places to look for a trade both sides of the road

GBPUSD monthly chart

The area around the low 1.48's looks strong support but a break would target the years lows. The low 1.45's also look good technically. Below 1.4250/1.42 and 1.40 will come into play.

I would say that 1.45 is in the realm of possibility, and if the UK services PMI suck tomorrow then we could be halfway there, from here, by the close tomorrow

I'm still short EURGBP so I haven't committed complete treason ;-) The strategy for that one is still very strongly in my favour and could be more so after Draghi has left the room tomorrow, so I'm not worried about that

In all trades you have to have discipline and you have to stick to it as best you can. We could be back above 1.50 tomorrow and my throwing the towel in will look silly. That's tomorrow though and hindsight doesn't make you money. Was it an easy decision for me? No, but we can only act on what we see and think in the moment. That's why we're ForexLive, not ForexYesterday

Update: Cable continued lower for the next month, hitting 1.4098 although it did bounce as high as 1.5242 in the middle of the month. It continued lower from there in the months ahead.