The New Zealand CPI was weak (1% YoY vs 1.2% estimate) and it has sent the NZDUSD sharply lower. The 1% level is the lowest since June 2013. The RBNZ thinks the currency is high and the lower CPI may be a showing that effect.

Trade data tonight will be an influence. The trade balance has been negative now for 2 months. The expectation is for another down this month at -625M (Exports are expected to be 3.5B while imports are expected at 4.2B).

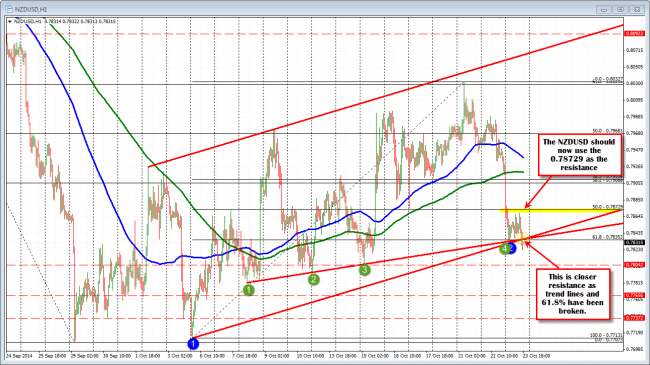

The NZDUSD is back below 50% and also below trend lines and 61.8% at 0.78352. Risk.

From a technical perspective, the 0.7873 is the 50% of the move up from October low to October high. This should be line in the sand type level now. Patient sellers should find sellers here. Closer resistance now comes in at the 0.7835 which is 61.8 and also where trend line come together. Hard to sell new lows after the big trend like move today, but technicals from the chart above are not bullish (need to get back above the 0.78352 level) and the buyers are the ones still feeling the pain.