Forex news for NY traders on Feb 15, 2017.

- What's expected for the Fed now

- US Crude oil futures settle $53.11

- Charlie Munger on China

- Can the the dollar run? We will know if...

- Puzder to withdraw nomination for Labor Secretary

- Yellen wraps up final day of testimony

- Yellen says she doesn't see risk in Fed holding MBS

- Fed's Bullard: Given economic numbers, Fed can hike later this year

- Fed's Harker: CPI data showed continued movement toward Fed's goals

- Fed's Rosengren: May need to hike rates more aggressively than 3 times per year

- Yellen: Investment spending has been quite low

- FTSE maintains its hunt for record highs

- Atlanta Fed GDPNow 2.2% vs 2.7% prior

- The dollar's failure is complete

- Like clockwork: Trump talks taxes, stocks hit record

- Spain's de Guindos is expecting inflation to moderate in Q2

- Trump: We will lower tax rates for people and businesses

- Yellen: Economic performance has been quite disappointing

- US EIA weekly oil inventories +9527K vs +3500K expected

- The ECB and Fed have a philosophical rift on commodity inflation

- Ireland's Kenny: Talk of punishing the UK for Brexit is deeply unwise

- US Feb NAHB housing market index 65 vs 67 expected

- The dollar gives it all back

- Yellen part two matches Yellen part one

- The Nov-Dec confidence surge is showing up in hard data

- January 2017 US industrial production -0.3% vs 0.0% exp m/m

- Canadian Jan existing home sales -1.3% vs +2.2% prior

- US workers didn't get a raise in the past year

- Canada December manufacturing sales +2.3% vs +0.3% expected

- US workers didn't get a raise in the past year

- January US advance retail sales +0.4% vs +0.1% expected

- January 2017 US CPI 2.5% vs 2.4% exp y/y

- US empire manufacturing index for Feb 18.7 vs 7.0 est

- Canada December manufacturing sales +2.3% vs +0.3% est.

The data out of the US was pretty good with the exception of the wages data in the CPI report. The retail sales were better than expected at +0.4% (vs 0.1% est). The core retail sales were +0.8% vs +0.4%. CPI came in at +0.6% and core CPI came in at +0.3%. The monthly hourly wages fell -0.6% though and the YoY came in at 0.0%. No raise for workers.

The dollar moved to new highs after the release of the data. Then the gains started to unravel. Was it the wages? Well it certainly contributed as a story line for the price action and despite Fed Yellen's Part II testimony (same as the first), and other Fed members who spoke with more of a hawkish slant, the dollar lost value. The dollar gains against all the major pairs were fully reversed, before a modest afternoon rebound.

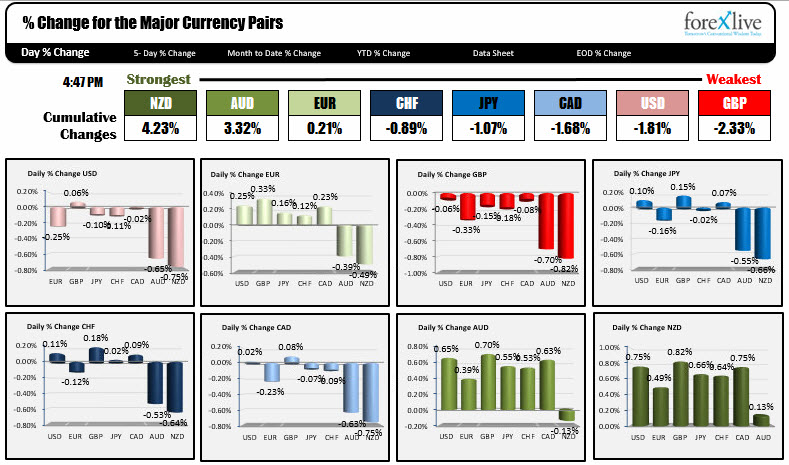

Overall, the greenback ended the day with modest changes against the EURUSD, USDJPY, GBPUSD, USDCHF, USDCAD, and pushed lower vs the AUDUSD and the NZDUSD.

In other markets:

- S&P, Nasdaq and Dow all closed at record levels again. The S&P was up 0.5%, the Nasdaq was up +0.64%, and the Dow was up 0.52%

- US debt yields were higher by 1-3 BP. 2 year was up 1 BP, 5 year was up 3 BP, 10 year was up 2.3 BP, and 30 year was up 2 BP

- Spot gold is trading up $4.80 or +0.39%

- Crude oil is down about -$0.20 or -0.40% at the end of the day

What are some of the technical levels in play for the major pairs heading into the new trading day?

EURUSD. The EURUSD has the 100 hour MA above at the 1.0610 level. The pair has not traded above the 100 hour MA since Feb 6th. A move above should be more bullish On the downside the pair needs to get and stay below the 1.0578-1.05879 area. In the middle of that range is the 50% of the move up from the January 2017 low at 1.05839. Get below is more bullish.

USDJPY. The 100 hour MA is below at 113.843. That MA held support on the fall today. On the topside, the 200 bar on the 4-hour chart was tested in the NY session (after the tumble that is) and that MA held. Both MAs matter to traders. We trade in between at 114.139.

GBPUSD. The price today fell below support levels defined by the 100 day MA (at 1.2324 in the new day. The swing level at 1.2422-17 (see post here), and the 200 bar MA on 4-hour chart at 1.23947 currently. All those were reversed. If the price is to go lower, those need to be broken. On the topside, the 100 and 200 hour MA at 1.2484 will need to be broken to push this pair back higher in the new trading day.

USDCHF. One level in play right now...The 100 hour MA at 1.0047. The market is testing the level near the close. If there is a break, look for more selling. Until then, the buyers are more in control.

NZDUSD. The NZDUSD was hit down to the 100 day MA on Tuesday at 0.7131 and that MA stopped the pair. Today, the price moved higher and broken the 100 hour MA on the dollar weakness. The rise has taken the price close to the 200 hour MA at 0.72367. We end the day trading above the 100 hour MA at 0.7183 but below the 200 hour MA at 0.72367.

AUDUSD. The AUDUSD moved above the 0.7696 triple top from this month's trading. The high reached 0.77188. If it can stay above 0.7690 bulls are in control.

Below are the % changes of the major pairs against each other vs each other. The NZD and AUD were the stongest. The GBP and USD were the weakest.