Forex news for NY trading on October 19, 2017.

- US stocks close well off lows and near highs for the day. Dow closes at another record.

- Trump leaning toward Fed's Powell as chair: Politico

- Forex technical analysis: NZDUSD has sellers still in control

- S&P trades back to unchanged as stocks work toward the close

- Bitcoin technicals: Bitcoin back above 100 hour MA

- Crude oil futures settle at $51.29/BBL

- Here's a new take on the crash in 1987

- BOE Cunliffe: We are not seeing sustained signs of domestic inflation pressure

- Catalonia won't declare independence before next week - report

- What's next for the New Zealand dollar after today's drop - BTMU

- 30 years ago today I was learning lessons on trading, the markets and risk.

- Was this another reason for GBP selling?

- Merkel says Brexit progress not sufficient to move to Phase 2

- Markets are in a bad mood on the 30th anniversary of Black Monday

- September Philly Fed business outlook +27.9 vs +22.0 expected

- US initial jobless claims 222K vs 240K estimate

- NZD gets hammered on coalition news. CHF safety bid makes it the strongest.

A snapshot of other markets as the NY trading day comes to a close shows:

- Spot gold rose $8.50 or 0.67% to $1289.79

- WTI crude oil fell -$0.65 ore -1.21% to $51.40

- US yields were lower on the day: 2 year 1.532%, down -3.2 bp. 5 year 1.9532%, down -4 bp. 10 year 2.3142%, down -3.1 bp. 30 year 2.833%, down -2.3 bp

- US stocks are ending mixed

It has been 30 years since the largest 1-day percentage drop in the US stock market. It happened on a Monday and as a result, was called "Black Monday" by the newspapers and the media at the time.

On that October 19th in 1987, the US stock market fell about 23%. The lessons learned from that day helped to lead to circuit breakers that slowed subsequent market declinesThis is, and there thankfully has not been a day like that day since.

Nevertheless, Todaythe stock market today, opened lower (S&P down -15 points, the Dow down about -105, the Nasdaq was down -67 points) and there were some uneasy feelings. The

However by the end of the day, the indices recovered and although the Nasdaq closed down -0.29%, the Dow and the S&P had small gains. That was good enough for yet another record close for the 30 large cap stocks that make up the Dow.

So stories were told and relived on the business news channels (including my own recollections here), but history did not repeat itself.

As far as economic catalysts today, the Philly Fed Business index, and the weekly jobless claims came out better than expected (although claims are still being influenced by hurricane data gathering problems). Later the leading index for September was weaker than expectations at -0.2% vs +0.1%.

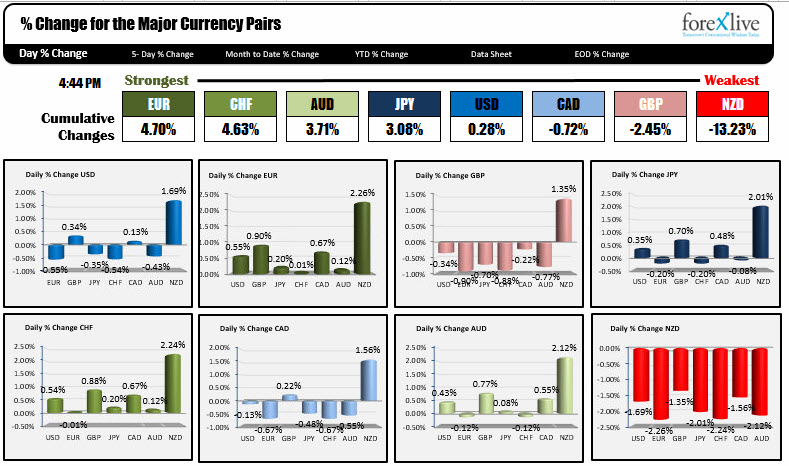

The bigger market moving news came out of NZ with the forming of a coalition government. That news send the NZD pairs down sharply. The declines of the kiwi against the major currencies on the day ranged from -1.35% vs the GBP to down -2.26% vs the EUR (see chart below). Those are pretty hefty % declines for a single day. However, compared to the NY opening, the changes in the session were minimal (most of the damage had been done).

The strongest currency for the day was the EUR. The USD - in addition to the gains against the NZD - was higher vs the GBP (+0.34%), the CAD (+0.13%), but lower vs the EUR (-0.55%), the JPY (-0.35%), the CHF (-0.54%) and the AUD (-0.43%).

Some technical lelvels to eye in the new trading day:

- For the NZDUSD the 100 week MA comes in at 0.7030. That will be a barometer for buyers and sellers in the new trading day.

- The USDJPY has found support against the 100 hour MA the last 4 or so tests. That MA comes in at 112.33. Stay above is more bullish. We trade at 112.52 at the end of the trading day. The 100 bar MA on the 4-hour comes in at 112.54.

- The EURUSD stalled at the 200 bar MA on the 4-hour chart at 1.1856. Last week the pair stalled against that level on 4 separate 4-hour bars. The 1.1876 is the swing low from June 2010. Last week the high reached 1.1879 before falling back to 1.1729 low this week. The pair is trading at 1.1848 currently. Get above the MA line at 1.1856 is step one. Get above 1.1876-79 is step 2 for the bulls. For sellers, stay below those levels nd get below 1.18219 (see post on the EURUSD here), and there should be more selling.

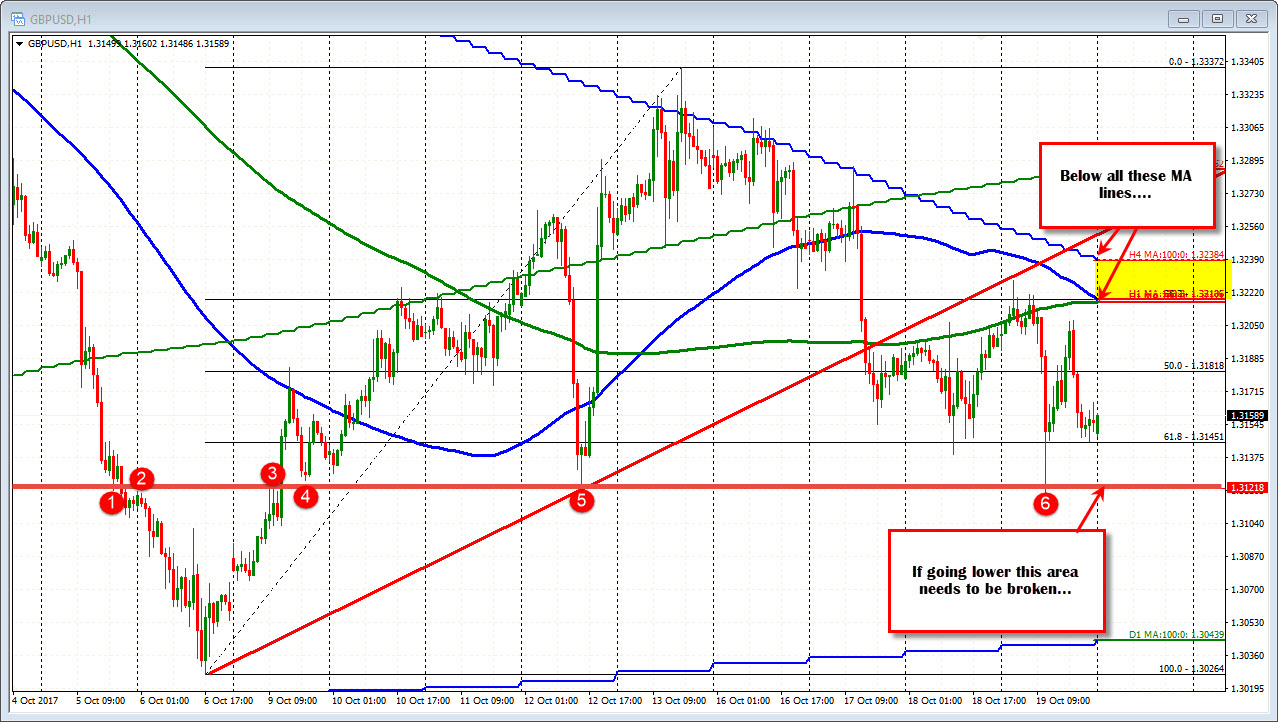

- The GBPUSD trading up and down in trading today. but closed lower and nearer the lows for the day. The 1.3121-22 area is home to swing levels going back to early October. Keep that level in mind on continued selling in the new trading day (trading at 1.3159)