A change in sentiment and the subsequent move in a currency can be very volatile. The landscape shifts and people get caught out and it can take a while for things to sort themselves out.

We’re seeing just such an event on the kiwi as it faces the reality of the current RBNZ stance.

If traders thought the moves were done after the meeting on Wednesday then they’ve had a rude awakening today.

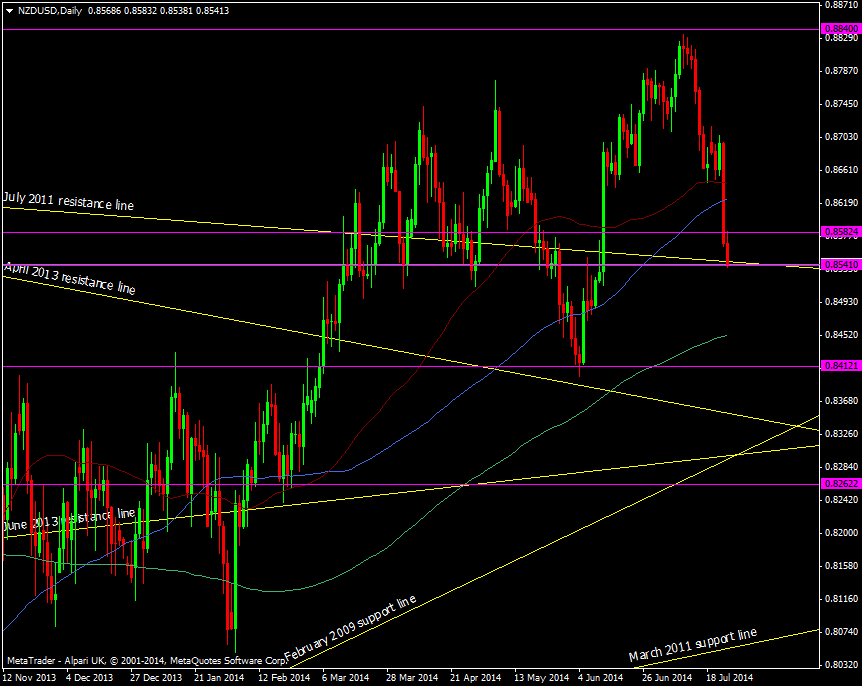

Inn the last hour or so we’ve lost about 40 pips to a new low at 0.8541 and it’s only now that we’re starting to enter the area where we can see some stronger levels.

NZD/USD Daily chart 25 07 2014

One of those stronger levels is here at 0.8540 and that’s where we’ve held up. Below that we should encounter support around 0.8475/80 then 0.8400/12 level being a former S&R level and the June spike low.

The market is pretty simple at times and the move up based on interest rate rises and the fundamentals was pretty much par for the course. The move down may well get overcooked while the market finds its balance from the latest news on rates. As rate cuts are unlikely the path from here is flat for rates with an upside risk, so the NZD isn’t likely to stray too far further down.

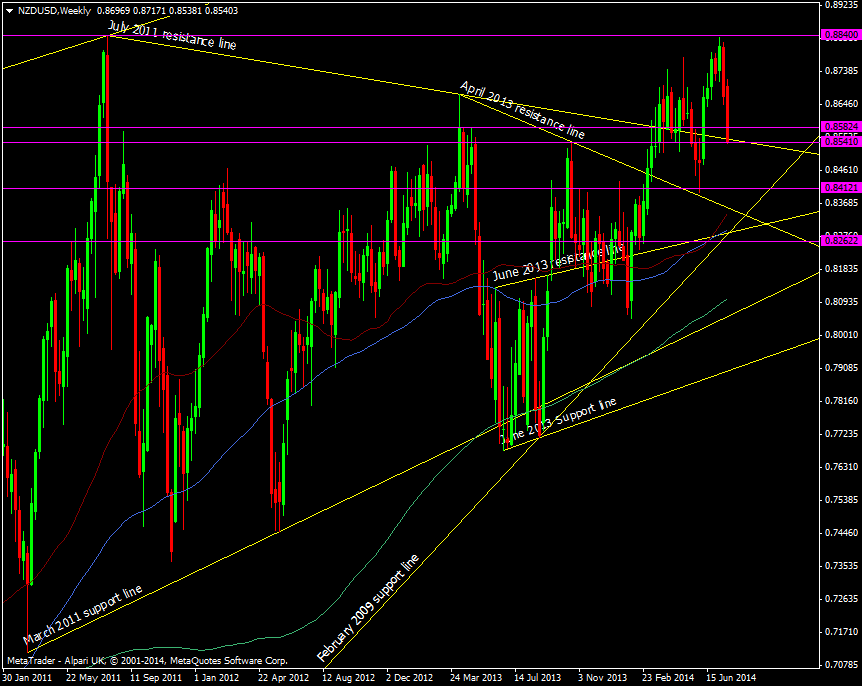

NZD/USD Weekly chart 25 07 2014

If we do crumble much lower I’d be looking at the Feb 2009 support line and around the 55 and 100 wma’s as a point to start scaling in longs. It’s quite a way away but worth keeping an eye on.