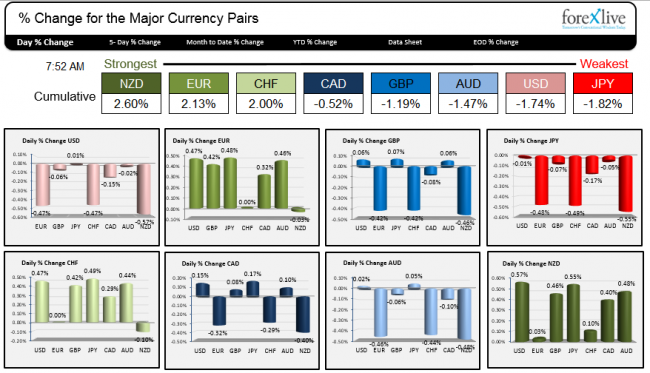

The NZD is the strongest currency in trading today.. There was no news, but favorable technicals and a weaker dollar and JPY helped the currency gain. The JPY is the weakest currency today as the sale tax was officially delayed until 2017 and Abe called a snap election.

The NZD is down the most against the JPY and the USD. Against the greenback, the pair is recovering after the sell off yesterday found support against the 50% midpoint of the move up from the Friday low. The ability to hold that level, has helped the technical picture for the pair. The next hurdle is to get above the high from early Monday. The high price from October comes in at 0.80327. The dairy auction results are still awaited. This can have an impact on the value of the NZD

The NZDUSD bounced off the 50% midpoint of the move up from Friday – keeping the buyers in control.

The weakest currency is the JPY. Prime Minister Abe announced the proposed sales tax will be suspended until 2017 and that he would dissolve parliament on November 21 and seek reelection. The PM is looking to extend his term (he is in year 2 of a 4 year term) so that the implementation of the Abenomic’s can be completed. The 1st sales tax increase has led to 2 quarters of negative growth and puts into question his economic stimulus based on monetary easing, stimulus spending and structural reforms.

From a technical perspective the EURJPY was one of the bigger gainers in trading today. The pair was helped not only by the announcements in Japan but also a stronger ZEW survey out of Germany which saw the Expectations component rise to 11.5 from -3.6 last month (and 0.5 expectations). The price is back above the high price from the end of December 2013 (at 145.67. Both Friday and yesterday, the price moved above this level, only to fail. Can the momentum be maintained this time. Watch the 145.67 level for support buying today.

The EURJPY is back above the high from the end of 2013 at 145.67

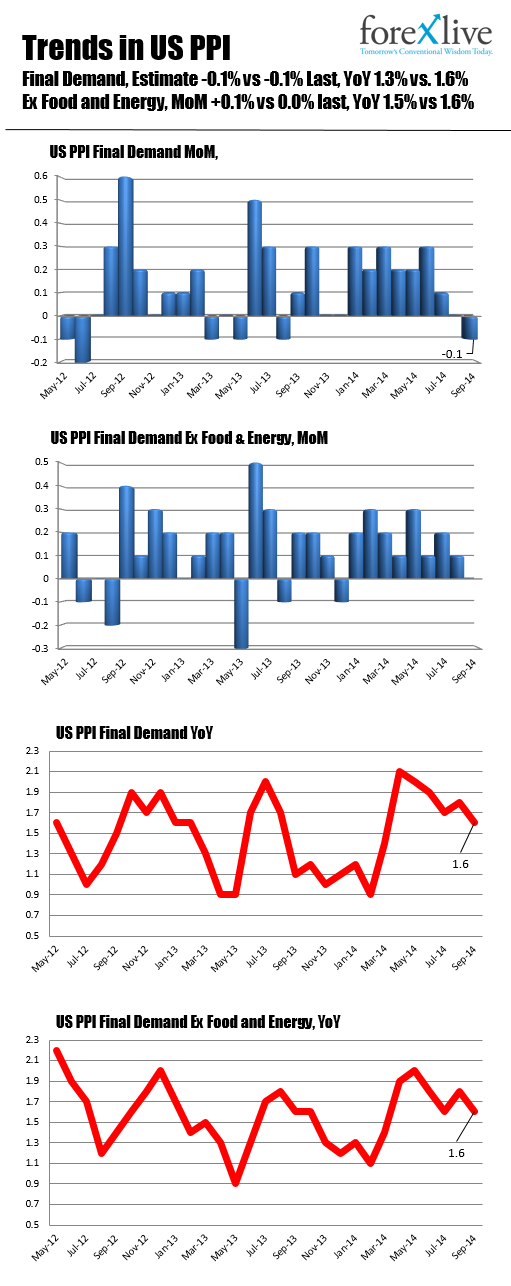

US PPI will be released at 8:30 AM ET (see trends below). The NAHB Housing Market Index will be released at 10 AM. US TIC data will be released later this afternoon in NY (4 PM according to Bloomberg). This is a new release time it seems.

US PPI to be released at 8:30 AM ET.