Latest data released by ONS - 20 August 2021

- Prior +0.5%; revised to +0.2%

- Retail sales +2.4% vs +6.0% y/y expected

- Prior +9.7%; revised to +9.2%

- Retail sales ex autos, fuel -2.4% vs +0.3% m/m expected

- Prior +0.3%; revised to 0.0%

- Retail sales ex autos, fuel +1.8% vs +5.7% y/y expected

- Prior +7.4%; revised to +6.8%

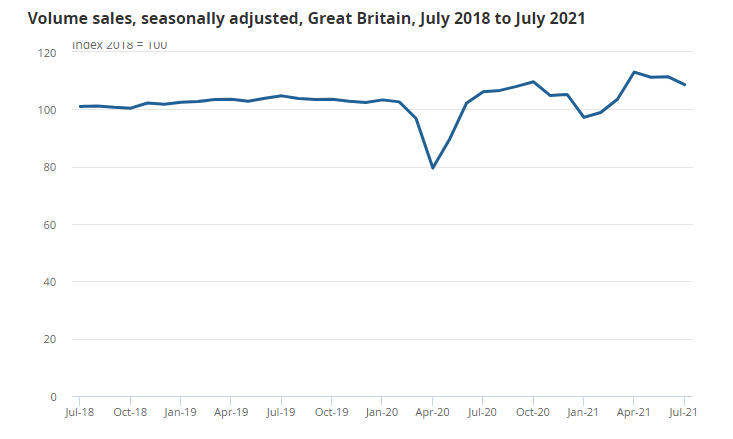

A considerable miss as UK retail sales activity sees further moderation after consumption levels spiked on reopening demand since April. Retail sales volumes for July were still seen 5.8% higher as compared to February 2020 i.e. pre-pandemic.

The details show that food store sales volumes fell by 1.5% while non-food stores also fell by 4.4% in sales volumes in July. On the former, ONS notes that:

This fall is broadly in line with data on UK spending on debit and credit cards, based on CHAPS payments made by credit and debit card payment processors, which also reported a fall in spending on staples (such as food) between June and July alongside an increase in social spending (such as eating out and takeaways), which may be linked to the further lifting of hospitality restrictions in July.

This does temper with the broader outlook of a continued strong recovery into Q3 but considering the levels of activity, it does keep the BOE on track to at least work towards normalising policy i.e. end asset purchases before year-end.