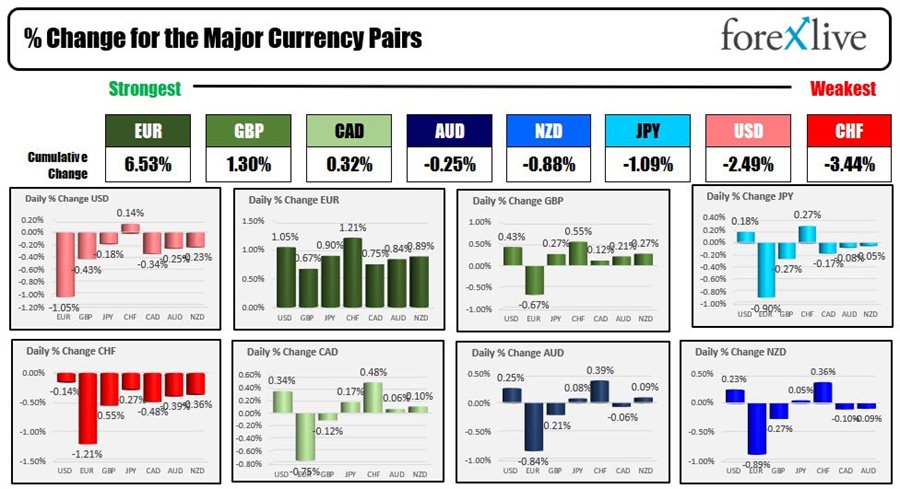

The EUR is the strongest and the CHF is the runaway weakest of the major currencies as the North American session begins. The USD is weaker as flow of funds heads out of the safety of the US dollar - and other currencies like CHF and JPY - and into the European currencies.

The moves are being helped by hopes for a peace agreement in Ukraine. Russia calls Ukraine talks constructive. That has stocks higher and also yields moving to the upside. Oil is trading lower. OPEC meets this week and is expected to keep the 400K BPD increase plan intact although there is question if production goals can be met. There is storm damage to the Capsian Pipeline Consortium that will likely limit Russian oil exports. There is also the question of weaning off Russian oil going forward. On the negative side, Shanghai rolling Covid lockdown remains a concern, and peace is still better than war.

In the US, the JOLTS job openings for February will be released at 10 AM along with consumer confidence for March. The consumer confidence is a more timely economic report. Included in the report is the present and expectations indices. The present situation remains well above the future expectations. Consumer confidence is expected to fall to 107.0 from 110.5 last month. Last month the present situation index moved up to 145.1 from 144.5. The expectations index meanwhile decline to 87.5 from 88.8 as inflation concerns way on consumer's expectations.

At 9 AM, the S&P Case Shiller home price index for January will also be released

A look around the markets is showing:

- Spot gold is trading down $-15.12 or -0.79% at $1906.75

- Spot silver is down $-0.42 or -1.72% at $24.40

- Crude oil is trading down -$4.40 at $101.32

- Bitcoin is trading higher $48,015. That is near the high price for the day $48,062. The low price was down at $47,082

US stocks are trading higher as result of the hope for peace news.

- Dow industrial average is up 202 points after yesterday's 94.65 point gain

- S&P is up up 25.5 points after yesterday's at 32.46 point rise

- NASDAQ is up 107 points after yesterday's 185.6 point gain

The European equity markets, the major indices are mixed:

- German DAX, +2.8%

- France's CAC, +3.1%

- UK's FTSE 100 +1.4%

- Spain's Ibex +2.5%

- Italy's FTSE MIB +2.6%

IN the US debt market, the focus is back on the Fed as a peace agreement may push growth back higher with inflation in its wake still lingering and potentially growing.

IN the European debt market, their yields are also on an upward trajectory today: