The latest in our series of previews highlights the release of provisional Q3 US GDP tomorrow ( Thurs 30th) at 12.30 GMT

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

Ryan considered the impact of this week’s durable goods orders on GDP in his preview here and it’s worth noting that those numbers, albeit volatile readings, came in well under expectations with a reading of -1.3% vs +0.5% expected, and would have been high on the FOMC’s discussion list today. And we can assume they’ve had a glimpse of the GDP reading too.

The U.S. economy grew at an annual rate of 4.6% in the second quarter of 2015 in the third and final estimate on Sept 26 which we posted here and showed the largest rise since Q4 2011.

US GDP 2009-2014

But analysts are being far more cautious this time around on the back of some indifferent data and whether a slowdown in global growth from Europe and China is beginning to affect the U.S. economy.

Although most economists are forecasting a downshift in US growth relative to Q2, this latest report is widely expected to reinforce the view that a moderate expansion remains intact.

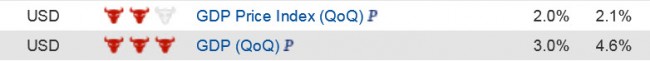

Median forecasts for the Q3 provisional reading are

US provisional Q3 GDP forecasts

Forecasts range from +2.6% to +3.6% and have all been reduced since yesterday’s dismal durables.

Fed chairwoman Yellen is speaking half an hour after the release giving the opening remarks to the National Summit on Diversity in the Economics Profession, which you can watch live here. The reaction to GDP either way may be muted, unless wildly off-piste, until we hear what she has to say, but the topic is not too price-action sensitive on the face of it.