The first Reserve Bank of Australia monetary policy meeting for 2018 is today.

- The announcement and statement will come at 0330 GMT.

- An on hold decision is expected.

I'll get some previews up for this, but here is a few already to be getting on with:

- RBA meet this week - preview

- Australia - RBA meet for the first time in 2018 next week - preview

- AUD traders - RBA meet this week, first for the year - preview

Prior to the RBA we'll get data from Australia today; retail sales and trade balance, both for December.

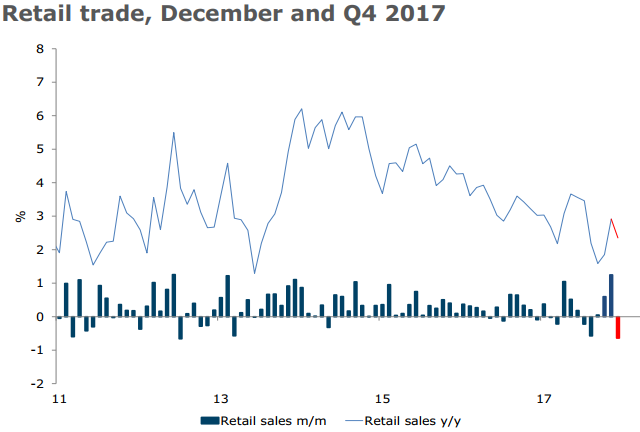

- expected -0.2% m/m

- prior +1.2% m/m

- Retail Sales excluding inflation for Q4, expected +1%, prior +0.1%

For retail sales:

Via ANZ:

- We expect a pullback in retail trade in December following the sharp jump in the previous month. A result in line with our expectations would see annual sales remain solid, at 2.4% y/y.

And, on the Q4 data:

- Given our forecasts, we look for retail volumes to have risen by 0.8% q/q in Q4, much stronger than in Q3, reflecting solid nominal sales growth but only a very modest rise in retail prices. While household balance sheets remain challenged, it is encouraging to see consumer confidence start this year on a solid footing.

---

Via National Australia Bank:

- After the release of iPhone X boosted retail trade in November, the market is expecting retail trade to be softer in December. We see the risk as even softer than the market.