Forex news for Asia trading Thursday 27 July 2017

- Heads up for more from the US on Thursday - durable goods (June)

- Moody's changes outlook for China's banking system to stable from negative

- Goldman Sachs raises forecasts for price of iron ore

- Further gains in EUR/USD plausible ... but limits to ECB tolerance likely

- Bumper China industrial profits data - but rising financing costs for companies

- AUD - RBA meet next week, preview. SOMP follows on Friday - preview also

- AUD/USD pops to a new high - some supportive data not hurting

- China June Industrial profits +19.1% y/y (+16.7% previously)

- Australia Q2 Import Price Index -0.1% q/q (expected +0.7%) & Export -5.7% q/q (exp -5.5%)

- PBOC sets USD/CNY mid-point today at 6.7307 (vs. yesterday at 6.7529)

- Australia press: China blocks Australian beef exports

- WSJ on the US & "The Myth of Trump’s Do-Nothing Presidency"

- Shock announcement from Australia .... oh, its OK, footy - related

- BNP on FOMC: dovish on the policy rate outlook, more hawkish on the balance sheet

- Is China's yuan being manipulated? Big Mac vs. Mini Mac

- BlackRock says index inclusion to drive flows into China onshore bonds

- No sign of North Korea's imminent missile firing yet says South Korea

- Japan policy adviser says country does not need extra fiscal stimulus

- More UK / Brexit news - commercial rent demand falls, & pay rises 'kept in check'

- UK interior minister to say Brexit will involve implementation period - no 'cliff'

- Brexit - UK car output down 13.7% y/y in June says industry group (but ...)

- US debt ceiling fight could derail Federal Reserve balance sheet plans

- North Korea could test ICBM later today (Asia, Thursday)

- All 17 primary dealers see Sept Fed announces start date for balance sheet reduction

- The fall in Australia's terms of trade will be confirmed today

- Blackrock's Rieder says we believe the Fed is targeting three rate hikes for 2018

- Forexlive Americas FX news wrap: Dollar not impresssed with FOMC statement

- Brazil cuts benchmark rate by 100bps to 9.25%

- Trade ideas thread for its not even Friday - Thursday 27 July 2017

- Fonterra lifts milk price forecast to NZ$6.75/kgms

- Barclays on FOMC, say their baseline expectation is Fed to begin B/S runoff in September

- US Senate votes against Republican proposal on healthcare

- Dow leads the way today. Record closes for Dow and Nasdaq

- Economic data calendar due from Asia today (we got a hard act to follow)

After a weak session for the USD overnight following the Federal Open Market Committee statement it was a bit more weakness for it in Asia today, notably against the Australian dollar.

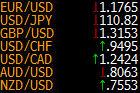

USD/JPY slipped below 111 (no news nor data flow of note); EUR/USD is testing its highs above 1.1740 (ditto for news and data flow); while cable has moved higher also, well above its US time highs and approaching 1.3150.

USD/CAD is fairly flat, as is oil, while gold is up a little. NZD/USD got a little boost from a Fonterra hike to its forecast farmgate milk payout (see bullets above) and its near its session high circa 0.7540+.

AUD/USD is well above 0.8, a steady flow of good news and data today helping it along after yesterday's up move also:

- Terms of trade (for Q2) came in lower - but this was well flagged and expected - with expectations now for an improvement in Q3

- China industrial profits surged, helping China proxies such as the Australian dollar

- Even Moody's got into the act, raising its outlook for Chinese banks

More on all these in the bullets, above. There is an RBA meeting next week (announcement due 0430GMT Tuesday 1 August). Its expected they'll express stronger concern about the strength of the Australian dollar. Good luck with that.

Regional equities:

- Nikkei +0.09%

- Shanghai -0.33%

- HK +0.43%

- ASX +0.20%

UPDATE --- As I post, a further slide for the USD taking currencies jumping higher again: