Forex and Bitcoin news from the European morning trading session 1 Mar 2018

News:

- China foreign ministry says that US has overused trade remedies

- Putin says Russia has developed missiles that no other country possesses

- Top US steel, aluminium executives invited to White House for possible major trade announcement - Reuters

- Trump likely to announce tariff of 25% on steel - Bloomberg

- EU's Tusk says that Eurozone economy is expanding strongly

- ECB's Nouy says Greek capital controls will be gradually eased and eventually lifted

- Riksbank's Ingves says monetary policy needs to remain cautious moving forward

- FX option expiries for the 15.00 GMT cut - 1 March 2018

- Japan upper house to hold BOJ confirmation hearings on 6-7 March - report

- US steel tariffs to add more woes to Canada

- Paul Tudor Jones says that bonds are well and truly in a bear market

- Cable's fall from grace isn't just about the dollar's recovery

- AUD/USD falls to session lows as risk trades are beginning to slump

- Risk assets sliding across the board, boosts the dollar

- Aussie faces a double whammy on selling against the dollar and kiwi

- SocGen says US yields to peak at 3% in Q3 as recession seen coming

- EUR/JPY posts session highs, what next?

- BofAML says that a cocktail of "threes" is to signal a top in markets

- Trading ideas for the European session 1 March

- Nikkei 225 closes down by 1.56% at 21,724.47

- Australia Feb commodity prices (SDR terms) y/y -1.0% vs -0.6% prior

- ForexLive Asia FX news: AUD lower

Data:

- Eurozone January unemployment rate 8.6% vs 8.6% expected

- Italy January unemployment rate 11.1% vs 10.8% expected

- Spain Q4 2017 GDP q/q +0.7% vs +0.7% prelim

- UK Jan mortgage approvals 67.5k vs 62.0k exp

- UK February Nationwide house price index m/m -0.3% vs +0.1% expected

- UK February manufacturing PMI 55.2 vs 55.0 expected

- Eurozone Markit Feb mftg PMI final 58.6 vs 58.5 exp

- Germany February final manufacturing PMI 60.6 vs 60.3 prelim

- France Markit Feb mftg PMI final 55.9 vs 56.1 exp

- Italy February manufacturing PMI 56.8 vs 58.0 expected

- Switzerland SVME Feb mftg PMI 65.5 vs 64.0 exp

- Switzerland Q4 2017 GDP q/q +0.6% vs +0.5% expected

- Spain February manufacturing PMI 56.0 vs 54.7 expected

- Switzerland Jan retail sales -1.4% vs 0.7% prev

- Japan February consumer confidence index 44.3 vs 44.8 expected

- Japan February vehicle sales y/y -4.9% vs -5.7% prior

A busy data session to kick off the new month but it's had little impact as markets continue to focus elsewhere. Yen buying prevailing overall still amid general USD demand. Equities falling further.

Large option expiry interest is once again in play on EURUSD and we've seen falls limited by related demand putting a base on at 1.2180 from 1.2210 . EURJPY is off its lows but still capped by core supply in core pairs.

Ditto GBPJPY which remains on the back foot and helping to put a lid on GBP overall with GBPUSD posting new recent lows of 1.3727 from 1.3770.

USDJPY has sell interest at 107.00 also helped by option expiries with year-end yen repatriation still in play. 106.50 providing the base atm.

USDCHF remains underpinned above 0.9430 but rallies tempered by EURCHF supply

AUDUSD has continued its retreat after option-linked support yesterday at 0.7800 and now posted 0.7713 while NZDUSD has been helped by the AUDNZD supply.

USDCAD is underpinned still above 1.2800 on the general USD demand and chewing its way higher through 1.2850 as I type.

Bitcoin has mostly behaved itself and traded above $10700 after finding support into $10500.

Gold has fallen to $1310 from $1316, with oil and equities also on the back foot. DAX opened down -0.5% and now -1.6% as I type.

US Fed chair Powell steps up for part 2 of his testimony to congress at 15.00 GMT

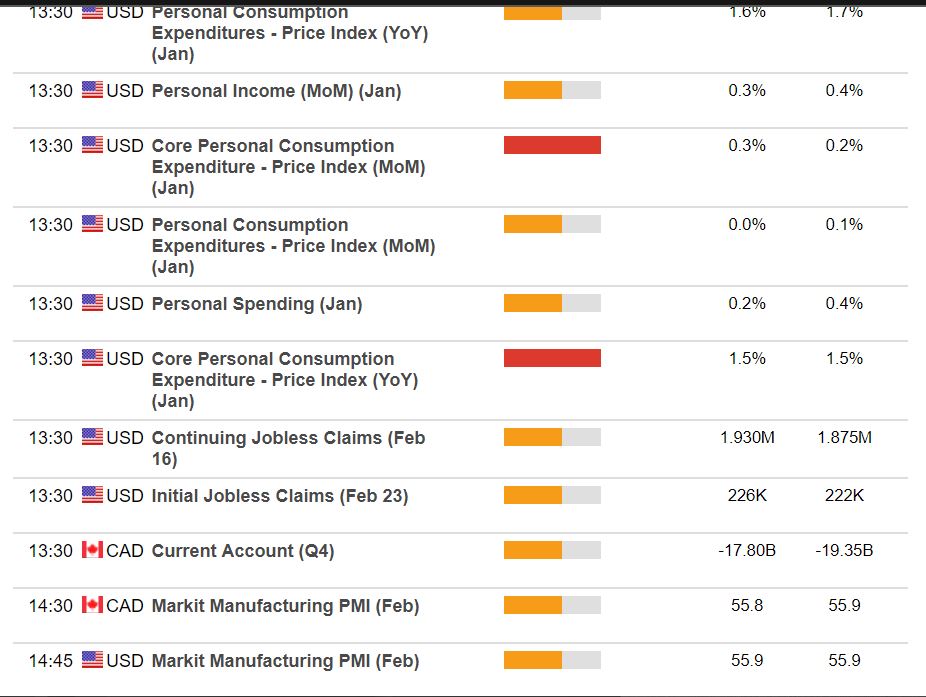

A fair raft of data to come as NA gets underway: