Forex news for the European morning trading session 12 Dec 2017

News:

- Three reasons why Bitcoin won't be a substitute for gold

- A recap of CBOE Bitcoin futures' first 24 hours

- Bitcoin futures and Bitcoin price movement: Correlation or causation?

- Bitcoin futures premium won't last forever

- Italy to declare state of emergency regarding energy supplies

- Pound retreats on post-data reality check

- BOE: Carney inflation letter to be published in February 2018

- Brent oil hits above $65, touches highest level since June 2015

- Forex option contract expiries for today 12 Dec

- German economy ministry: Sees strong economic growth in 2017

- Joseph Stiglitz: US tax bill the worst I have ever seen

- Moody's: PBOC's increasing use of liquidity facilities will improve monetary management

- USD starting to slip as markets are starting to come alive

- NZD/USD hits session highs, key levels to look out for

- Trading ideas for the European session

- Eurostoxx futures up 0.2% in early European trading

- Asian equities mostly lower on the day

- Nikkei 225 closes down -0.32% at 22,866.17

- ForexLive Asia FX news wrap ... stay tuned for UK inflation data

Data:

- UK November CPI 3.1% vs 3.0% y/y expected

- Germany Dec ZEW current situation 89.3 vs 88.7 exp

- UK Nov PPI output NSA mm 0.3% vs 0.3% exp

- France Q3 non-farm payrolls +0.2% vs +0.3% q/q prior

- Japan Oct tertiary industry activity +0.3% vs +0.2% m/m expected

Overall another lacklustre session as the Fed looms large tomorrow but once again we've seen some GBP action in the wake of inflation data and ongoing Brexit concerns.

P/A summary:

- GBPUSD rallies to 1.3380 from 1.3355 on stronger mm/yy CPI data but core remains unchanged and reality check selling sends the pair back down to 1.3311 before bouncing back

- EURGBP drops to 0.8807 post-data before rallying to test 0.8850

- EURUSD steady around 1.1775 with neutral ZEW data

GBPUSD 15m

- USDCHF had an early dip from 0.9920 to 0.9890 but since rebounded

- USDJPY tightly bound 113.40-55 for the most part

- AUDUSD steady ascent 0.7540 to 0.7580 before capping

- NZDUSD also climbed steadily from 0.6930 to 0.6955 before also capping

- USDCAD drifted down to 1.2820 from 1.2855 helped by firmer oil prices

- WTI and Brent both higher with Brent outstripping to a 2 year wide-gap of $7 on Forties field outtages

- Gold fell from $1246 to $1242 before steadying

- Equities opened a little firmer and held gains

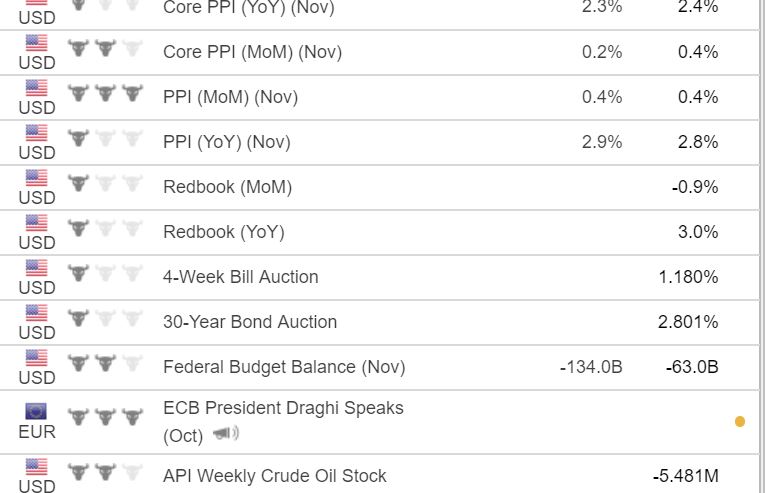

Next data risk US PPI at 13.30 GMT with Draghi up to the mic later at 19.00 GMT