Societe Generale's head of US rates strategy, Subadra Rajappa, speaks in an interview in Singapore

She says that US 10-year Treasury yields is likely to decline after peaking around 2.8% to 3.0% in Q3 as markets start to anticipate a US recession.

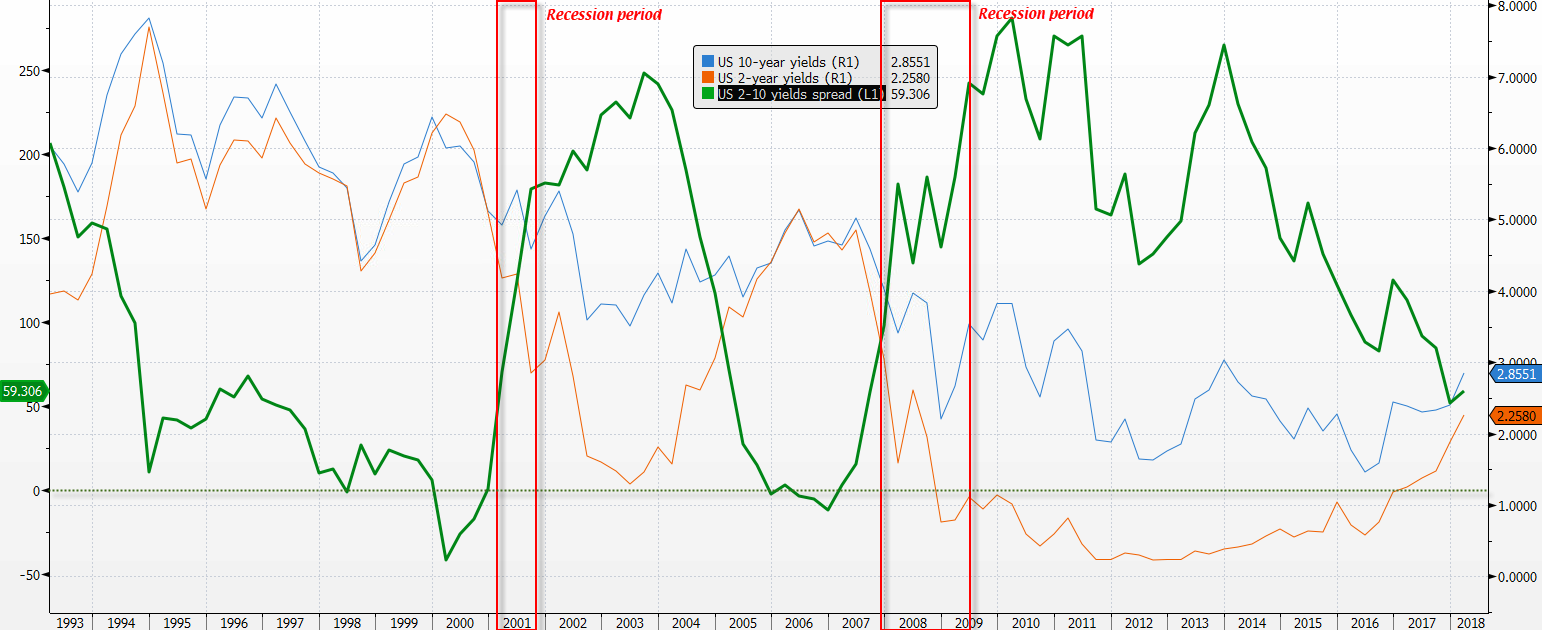

Rajappa also mentions that they forecast a US recession in late 2019 to early 2020, citing that if the US yield curve flattens or gets inverted amid a faster pace of rate hikes, it could feed into broader markets and trigger a recession.

She also argues that concerns which started late last year about a flattening yield curve (that usually signals a recession) isn't something to be dismissed.

Regarding the Fed, Rajappa says that the bank expects the Fed to raise rates 3 times this year as inflation is seen slowing down in 2H 2018, while adding that Fed chair Powell may "dial back" his tone in today's speech if he thinks that the market's reaction to his comments about a faster pace of rate hikes on Tuesday has been excessive.

Certainly a different take on things, and another point of view for all of you out there in forming your views on the market. Earlier in the day, we had a former BlackRock bond manager saying yields will hit as high as 4% and Goldman Sachs also made some comments about the possibility of it hitting 4.5% earlier in the week.