- Prior 0.75%

- Bank rate vote 6-3 vs 8-1 expected (Haskel, Mann, Saunders voted to raise bank rate 50 bps to 1.25%)

- Some degree of further tightening in monetary may still be appropriate in the coming months

- Two MPC members judged rate guidance as inappropriate considering risks to growth, inflation are more balanced

- Will consider starting process of selling UK government bonds now that bank rate is at 1%

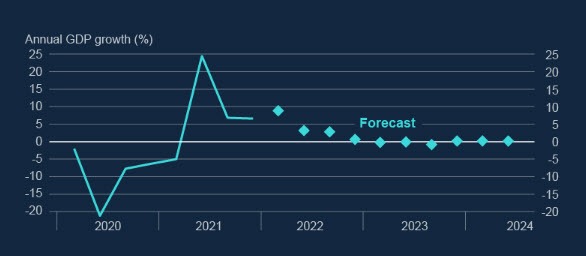

- BOE forecasts UK economy will slide into recession

- Expects further slowdown in the UK economy, inflation to rise by 10% this year

- Full statement

- Full summary

Even though the policy move and subtle change to the rate guidance on rates may appear more hawkish at first glance, the BOE is painting a rather dire picture of the economy moving forward. The central bank sees the UK economy contracting in 2023 as stagflation risks as well as the cost-of-living crisis weighs on overall activity.

I reckon that is in part causing a drag on the pound as they also kick the can down the road in terms of trimming the balance sheet. The forecasts by the BOE: