On October 7, 2016 the pound fell 10% in 40 seconds

Flash crashes in financial markets may become an increasingly frequent part of the landscape.

The preponderance of algos, instant electronic access and the illusion of liquidity make for fragile markets. In early January 2019, a flash crash took place in yen crosses. In 2016, it was the pound that fell 10% in less than a minute.

There are lessons in these events but they're not always the same. In the 2019 event, I wrote as the crash was underway:

"These are some of the biggest moves you will ever see. I'm sticking my neck out here but this looks like a one-off liquidity event and those tend to retrace."

The moves all did.

For those who bought the dip it was an incredible buying opportunity. One that yielded hundreds of pips in minutes and hundreds more within days.

The cable crash was similar. The pound plunged but was able to recover most of the gains.

One thing was entirely consistent: the timing. Both flash crashes happened at the most-illiquid time of day -- after the US shuts down and before Tokyo really ramps up. The yen crash also took place on a Japanese holiday, thinning liquidity further.

But the algos don't sleep. Or do they?

A Bank of England analysis shows there were a healthy amount of bids on each side of the market -- £60 million of orders in the observed ten levels of price closest to the best bid and ask prices. Yet when the selling started, it vanished.

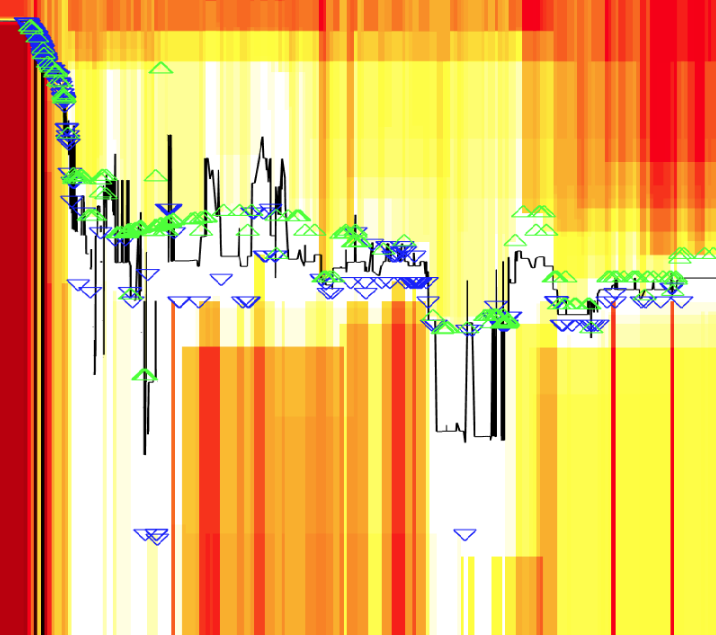

This chart shows triangles where transactions occurred on the Thomson Reuters platform. Those blue and pointing down show transactions initiated by a participant seeking to sell sterling. Those green and pointing up show trades initiated with an order to buy. The dark shaded regions show limit orders. The white areas indicate that liquidity had completely vanished.

The implication is that the algos switch off once an event outside its limits takes place. Some algos might shutter after a 1 standard deviation move, others may only halt after 5 standard deviations but them dropping out might have cascaded just as stops were cascading lower. Ultimately there was no liquidity.

Looking deeper at the episode, the BIS concludes that the flash crash appears to have been triggered by a large order to sell the pound. At this point, it wasn't a major event but enough to send GBP/USD to 1.24 from 1.26 in a somewhat orderly fashion. That was followed by a number of minutes of "extreme dysfunction" in lower volumes that added up to a 10% decline followed by a gradual recovery.

"There is still a relatively limited understanding of the implications of widespread automated trading, the reduced role of traditional market-makers, and the increasingly important role of principle trading firms and other non-bank liquidity providers in FX and other market," the BIS concludes.

Here are my lessons for traders:

1) Trade with a stop

I read far too many heartbreaking messages from traders who lost far more than they could afford in the SNB, GBP and JPY flash crashes among other events. Most forex brokers now protect retail traders from negative balances but there's no excuse not to have a stop somewhere.

2) These are remarkable opportunities

These are harrowing episodes but they're opportunities. In practice, it's tough to be aggressive at a time like this but a small-sized trade to fade the move can be prudent.

3) Longer term outcomes vary

Ultimately, the pound fell much further after the GDP flash crash, which only helped to underscore the disorder in the UK after the vote. In other episodes, policymakers have levers to pull on that can and have reversed the sentiment, making these 'blow off' moves bottoms.

4) Algos are here to stay

Policymakers have tried to understand these moves but the answers haven't been satisfactory. Ultimately, I believe a global policy will emerge where central banks agree to coordinate in order to step in after certain parameters are hit. I think we've been lucky so far that none of these events spilled over into critical derivatives markets, leading to cascading problems in an event that leads to some kind of breakdown in a bank or the broader financial system. The trigger could easily be FX but ETFs are also vulnerable. Information will be at a premium when that happens and we here at ForexLive will be with you every step of the way.