Another strong move from the quid runs into the same upside trouble

From yesterday's lows we've added just over 180 pips to the 1.4570 highs and again we're finding resistance tough in this 60/70 area.

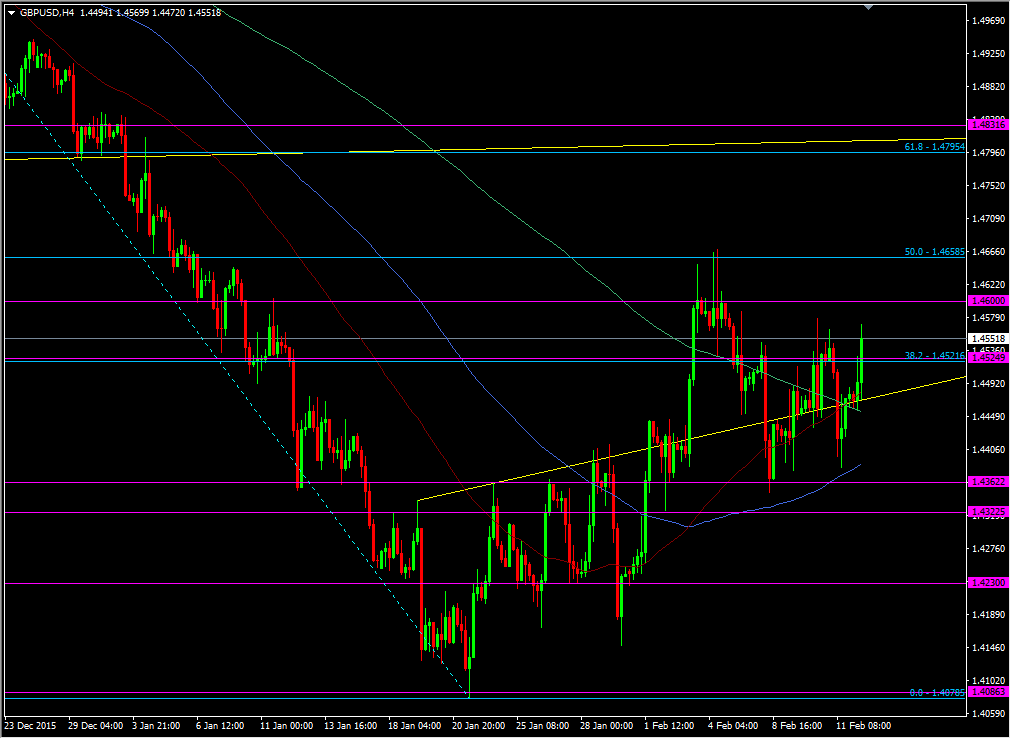

GBPUSD H4 chart

We don't seem to be trading with any real intentions, with so much focus elsewhere but the trend since the year started has been up and the series of higher lows suggests that we will get a proper test of 1.4600. If we do and manage a break then the 50.0 fib of the Dec tumble is next at 1.4658, which we've tested before

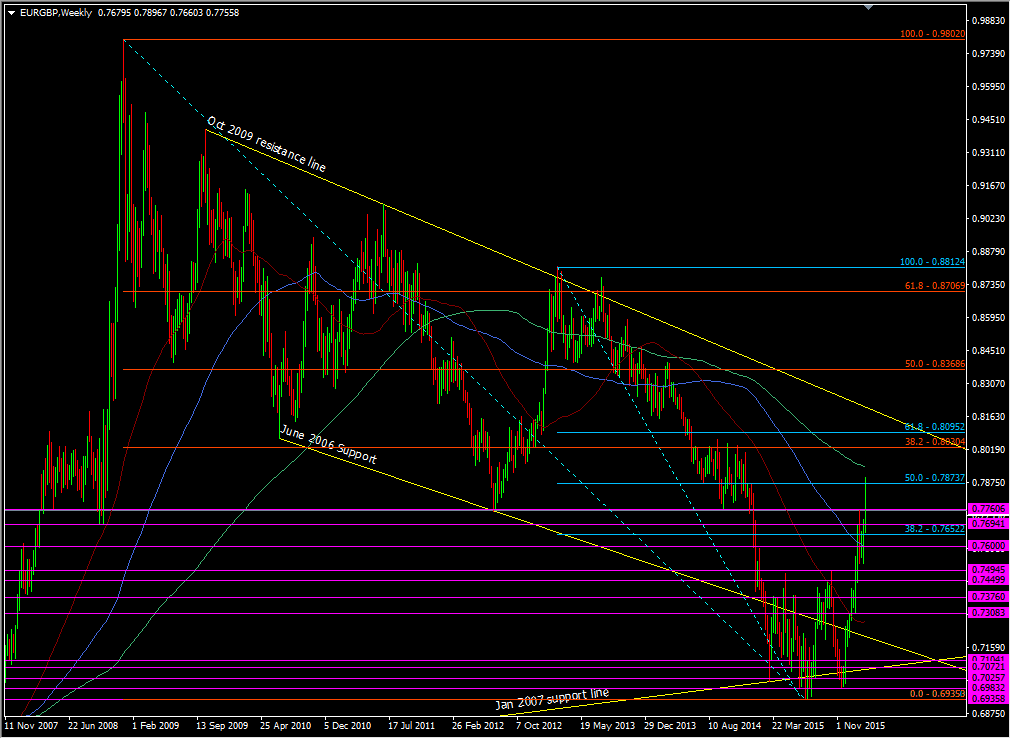

EURGBP is aiding cable's move and so far the rejection of 0.7900 has been swift and hard. Looking at the weekly chart we've also had a very quick move up from last year's lows and it's been one of the fastest and biggest moves up for a few years.

EURGBP Weekly

Whenever we get sharp moves like that it increases the risk of seeing a fast turnaround also. As we're approaching some strong technical resistance, there looks to be a good opportunity to scale in some shorts against them (200 WMA, 38.2 fib of the 2008 move, 61.8 fib of the 2013 move). One of those levels is at 0.8030, which was where I shorted back in 2014. I got out of the last of those shorts after we broke back up through 0.7500.

While a level was good once, and looks good again, we can't just rely on old reasons why we traded levels previously, to blindly trade them again. As much as I like the look of getting back into shorts I'm going to be assessing the reasons behind any move up to them. That should always be first and foremost of any strategy, "Why are we here?". If the reasons fit then I'll be happy to short. If not I'll leave it alone.