Job growth not so hot

The job gains were certainly not great at 142K and net rev of -59K (mkt was expecting a rev up). The Unemployment rate comes in a 5.1% unchanged. The earnings were not good at 0.0 MoM. The partcipation rate fell which helped the unemployment rate remain unchanged. The dollar is falling. Is it a one time aberration? If it is we will have to wait for the truth to come out. The Fed will have a lot of explaining to do if last month was a no go, but October is a go. So no Fed in October. December is a ? too now. The S&P futures moved to 1901 soon after the news.

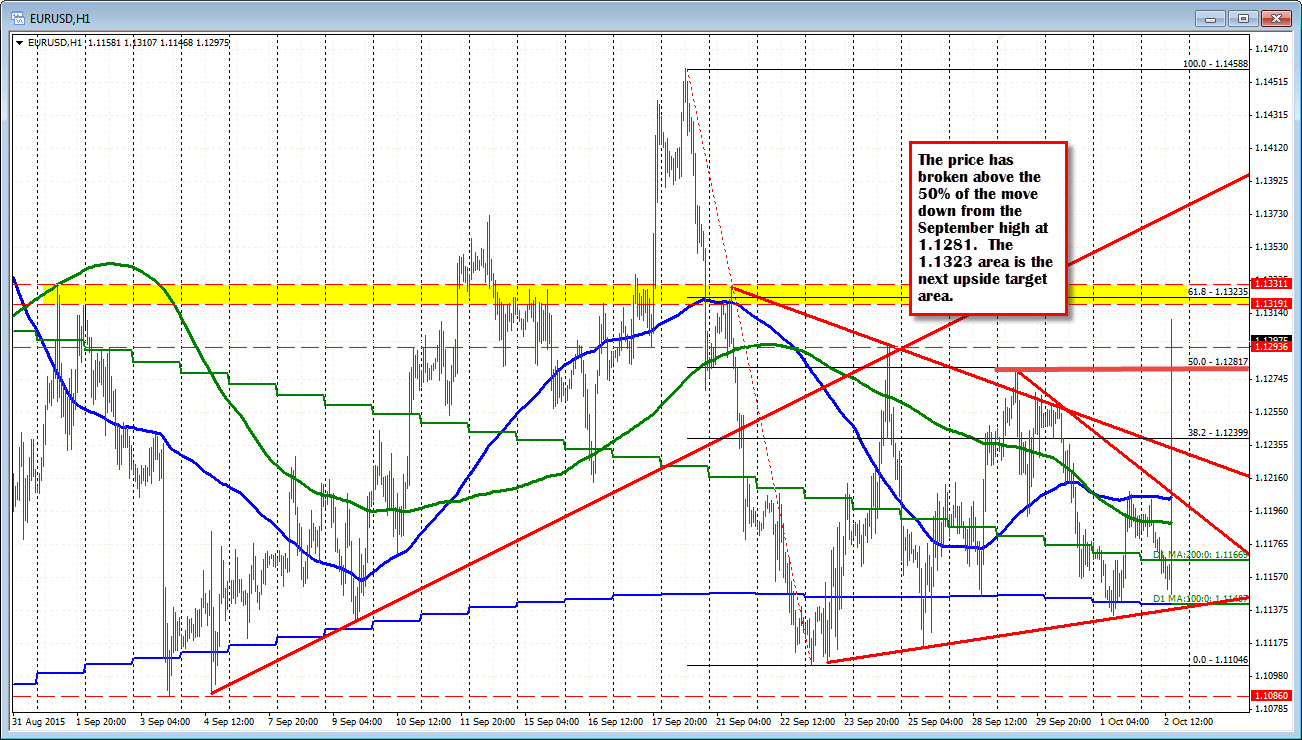

The EURUSD has not had a breathe on the way higher. The next target area comes in at the 1.1319- 1.1331 area (lots of swing levels in that range). The 61.8% retracement of the move down from the September high comes in at 1.13235. Close support will now be eyed at 1.12817. This is the 50% of the move down from September high and is also near the high swing price from September 29. A larger correction will come from traders getting offsides on their buying gotta think traders with positions were thinking short, Fed potential hike, etc. Wrong. Hence the covering. That is evident in the 1 minute chart. There has not been any breathe on the way higher except perhaps the one just now at the high. That correction stayed above the 50% retracement support at the 1.12817 level.