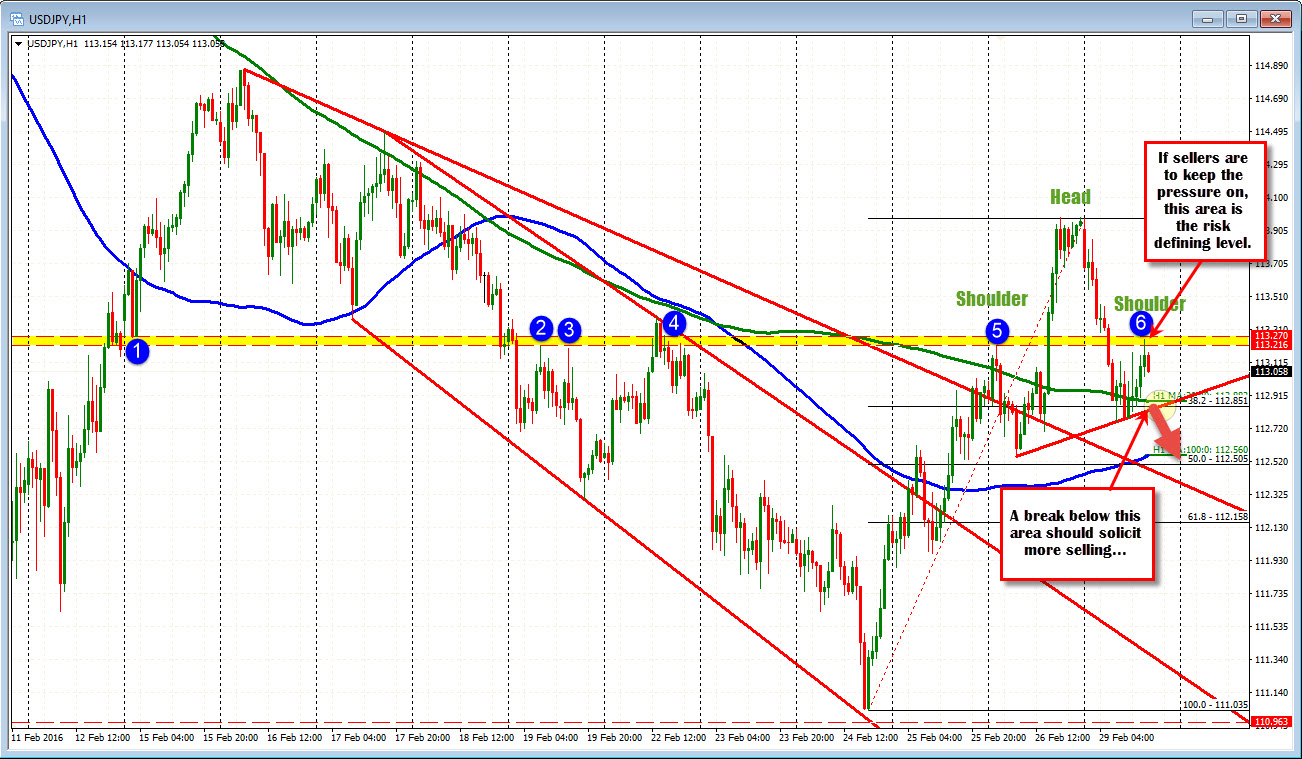

USDJPY tumbles lower. Corrects.

The USDJPY tumbled from the "get go" in trading today falling toward the 200 hour MA and 38.2% of the move up from last weeks low. The pair has rebounded toward an early swing high on Friday and in my minds eye are seeing visions of a head and shoulder formation forming.

For every H&S that forms, there is another that fails (we just don't hear or talk about them). So like to let the price action decide. Right now the 113.21-27 area seems like a level to lean against on the topside and a break of the neckline SHOULD get the ball rolling to the downside. The 112.50-55 area will be the next stop on a break (100 hour MA and 50% retracement). Of course pure aficionados of the head and shoulder will be targeting much lower but that area will be the first stop should sellers take firm control.

Looking at the 5-minute chart for clues, the price sits between the 100 and 200 bar MAs (the 200 bar MA held on the first test. Those lines will give traders more clues as to the next bias move today. Right now, traders are trying to make the H&S work but it has some work to do to make it a reality.