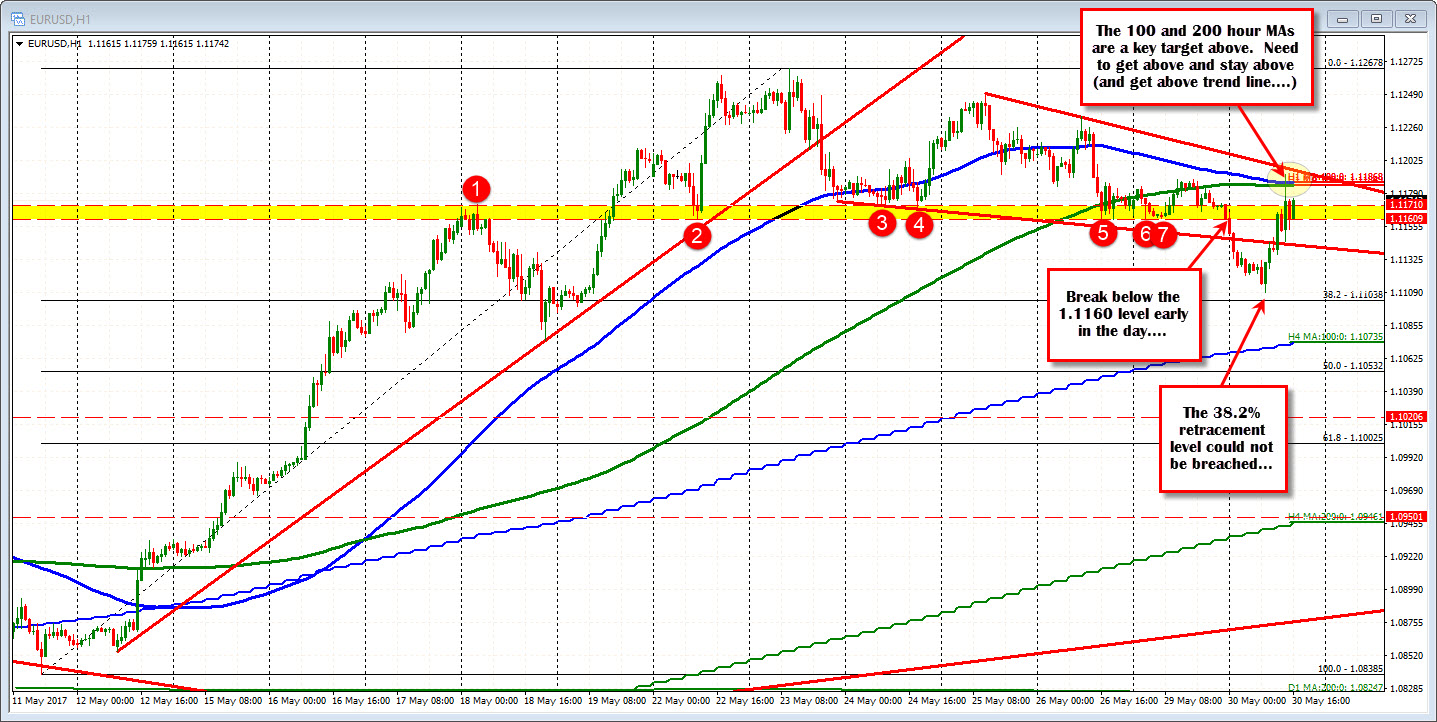

First look above, failed.

The EURUSD has had an up and down day.

The down in the early part of the day, took the price below the 1.1160-71 area (see yellow area) where there has been a number of swing levels. The move took the price toward the 38.2% of the move up from the May 11th low. That retracement comes in at 1.11038. The price low reached 1.1108 today.

The recovery higher, spiked on comments of ECB taper. That high reached 1.1193. In the process, the price moved above the 200 (green line) and 100 hour MAs (blue line) at 1.1185-869. Those MAs are key.

We trade above and below the 1.1160-71 area, but the current bar is holding the 1.1160 level. Are buyers showing their hand? Get above the MA lines and stay above.... that is the key.

PS. The commitment of traders report from Friday from CFTC showed that longs in the EUR were at the highest level since October 2013. If the market is long, traders want the price to go higher. The technicals on hourly chart show more support buyers against the 38.2% retracement, BUT they would prefer to see the MAs broken too. If not, there could be some further liquidation.