Hanging around days midpoint/100 hour MA

The USDJPY has moved lower on weaker US data but is being supported by stocks which are doing well and the EURJPY which is following higher with the surge in the EURUSD.

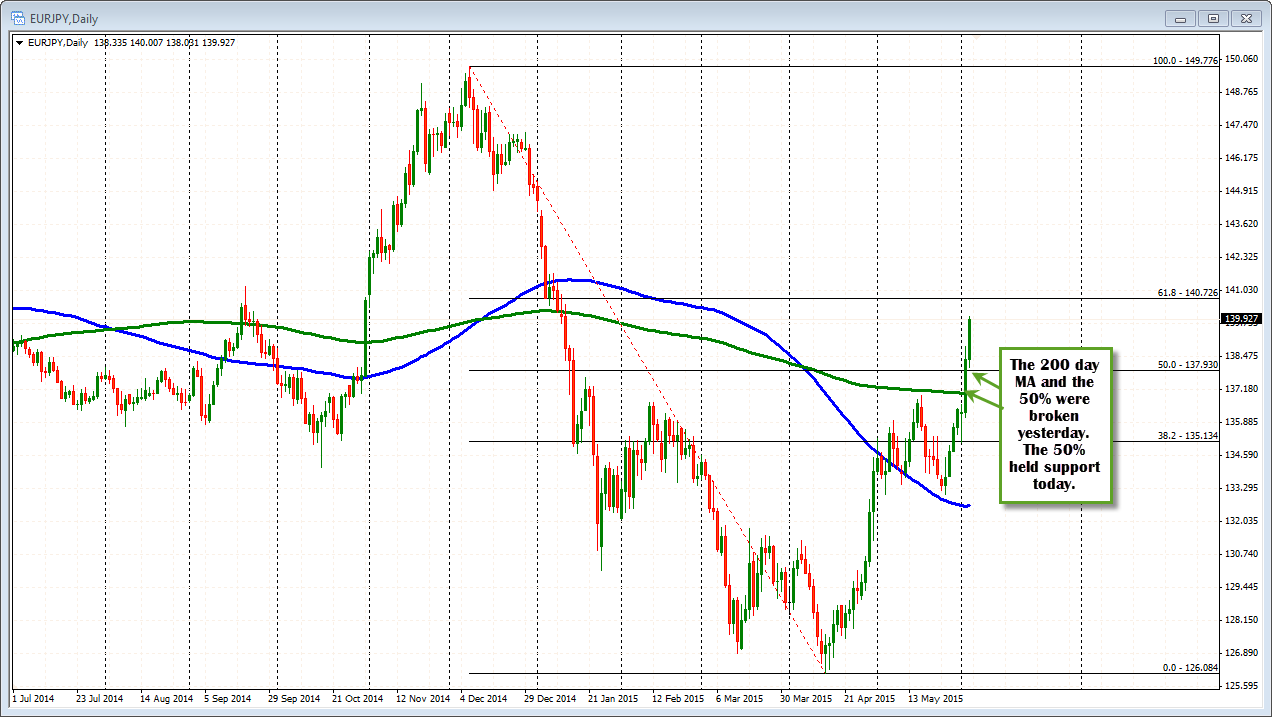

Looking at the hourly chart, the pair seems to be in a consolidation range after the trend move higher since the May 14 low at the 118.87. The high peaked at 125.04 yesterday (high trend line connecting highs from May 5th and May 28th) before moving below trend line support. The 100 hour MA broken as well, but the price did move higher during the early European trading today.

The fall in the NY session (current bar) has taken the price back below the 100 hour MA but overall compared to the surge in the EURUSD, the action is muted. If the price trend higher from May is to start to show more downside momentum a move below the 123.48-58 will be needed ( yellow area in the chart above). Yesterday's low in today's low found support buyers level for that area.

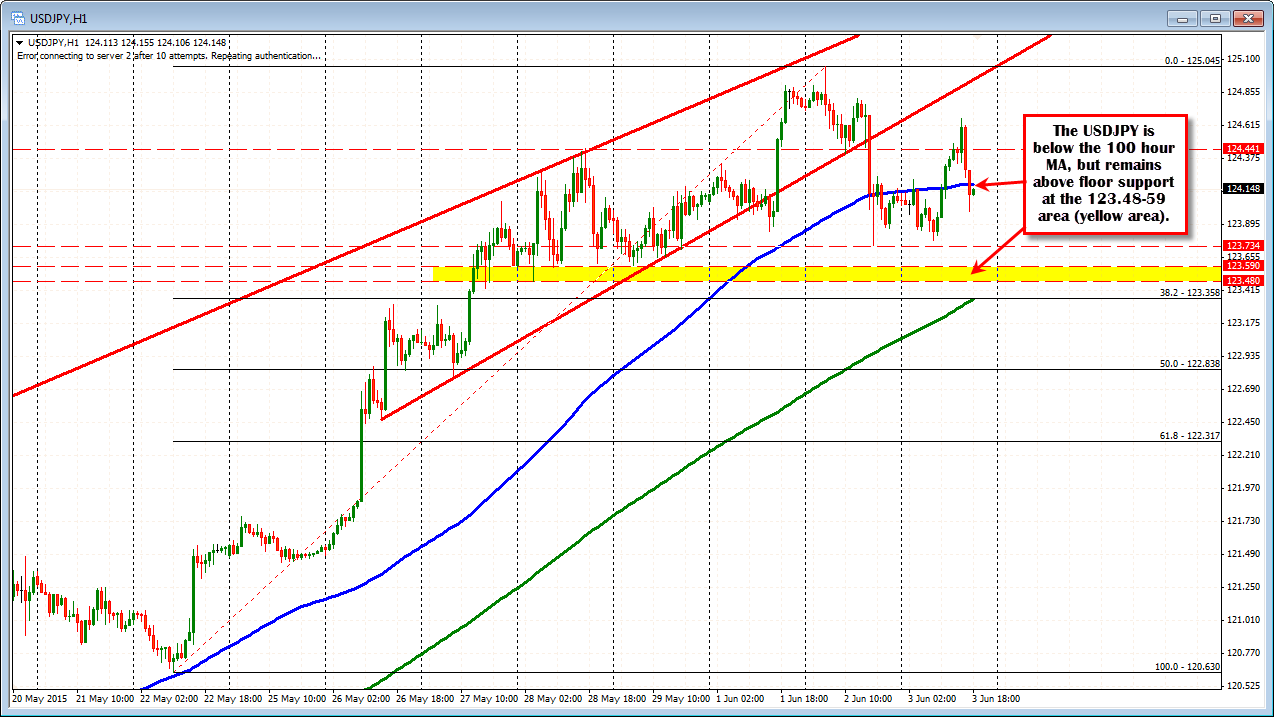

The EURJPY has been a contributor to the better bias in the USDJPY relatively. That pair is up on 6 of the last 7 trading days - part on the JPY weakness and more recently on the EURUSD strength (the last few days). Looking on the daily chart, the price surged above the 200 day MA and the 50% retracement level yesterday. Today the 50% held support and the pair has shot to new highs (since Jan 13). The 140.72 is the next target. It is the 61.8%of the move down from the December 2014 high.