The AUDUSD is hanging in there in trading today. There was a push higher early on, but the pair remains contained on the topside.

AUDUSD remains below the 100 and 200 hour MA (blue and green lines).

Looking at the hourly chart, the price for the AUDUSD has been trending steadily to the downside, with periodic corrective moves. Those corrections have been able to get above the 100 hour moving average ( see blue line in the chart above). However, none of them have been able to breach the 200 hour moving average (green line in the chart above). The high correction last week peaked right against that moving average and also the downward trendline. Currently those levels come in at 0.8283-88 (see chart above).

In trading today,on corrective rally, sellers came in against the 100 hour moving average. It was a same during Friday’s move higher. As a result, the sellers remaining control in the AUDUSD..

Although activity to the upside has been contained, the downside has also found support against the 0.8200 level. The last 3 lows have come in at 0.8205 0.8200 and 0.8199 (that is today’s low). A move below this level should open the door for further downside potential.

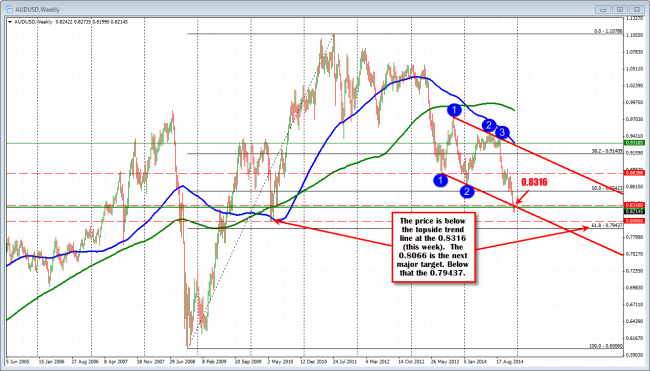

Looking at the weekly chart (see chart below),the price remains below bottom trendline support. The next major target would be the 2010 low, which comes in at 0.8066. The 61.8% retracement of the move up from the 2008 low to the 2011 high comes in at 0.79437 (see chart below).

AUDUSD is below the lower channel trend line.

Where is the close risk for traders?

Since peaking today, the price fell and tested first the 100 bar moving average (blue line in the chart below), and then the 200 bar moving average (green line in the chart below). Over the last few hours, the price has been able to stay below the 2 moving averages. Watch of these levels, for a close risk, defining level for the pair. Alternatively the 50% retracement of the move down from the top can be used as well. That currently comes in at 0.82417, but will move lower, if new lows are made.

The AUDUSD has been showing more signs of downside momentum in trading.

From a fundamental perspective, last week, Gov. Stevens said that given lower commodity prices, the value of the AUDUSD should decline to 0.7500. Around this time last year, Steven’s said the fair value of the currency was 0.8500. The price reached the 0.8500 level at the end of November. In December, the price has deteriorated further to the 0.8200 level.

Also last week, the Reserve Bank of Australia kept rates unchanged and repeated that the most prudent course is a period of rates stability. They also commented that subdued job market may weigh on consumption and confidence. Deutsche Bank and Morgan Stanley are now expecting the RBA to cut rates in 2015, despite the fact that others see the Reserve Bank of Australia raising rates along with the Fed in the 2nd half of 2015.

Deputy Gov. of the RBA Lowe commented early in the month that “If further interest rate reductions were required they would have some effect on stimulating economic activity”. Some of the market thought that his comments were an indication that the Reserve Bank of Australia was more slanted in that direction.

GDP for the 3rd quarter came in at 0.3% vs. the consensus estimate of 0.7%. This was a lowest quarter on quarter growth going back to March 2013 when growth was also 0.3%. Business confidence was released last week and it came in at its lowest level since July 2013.

In the new trading day, Westpac leading index for the month of November will be released also skilled vacancies will be released.