Dust settling in nervous markets

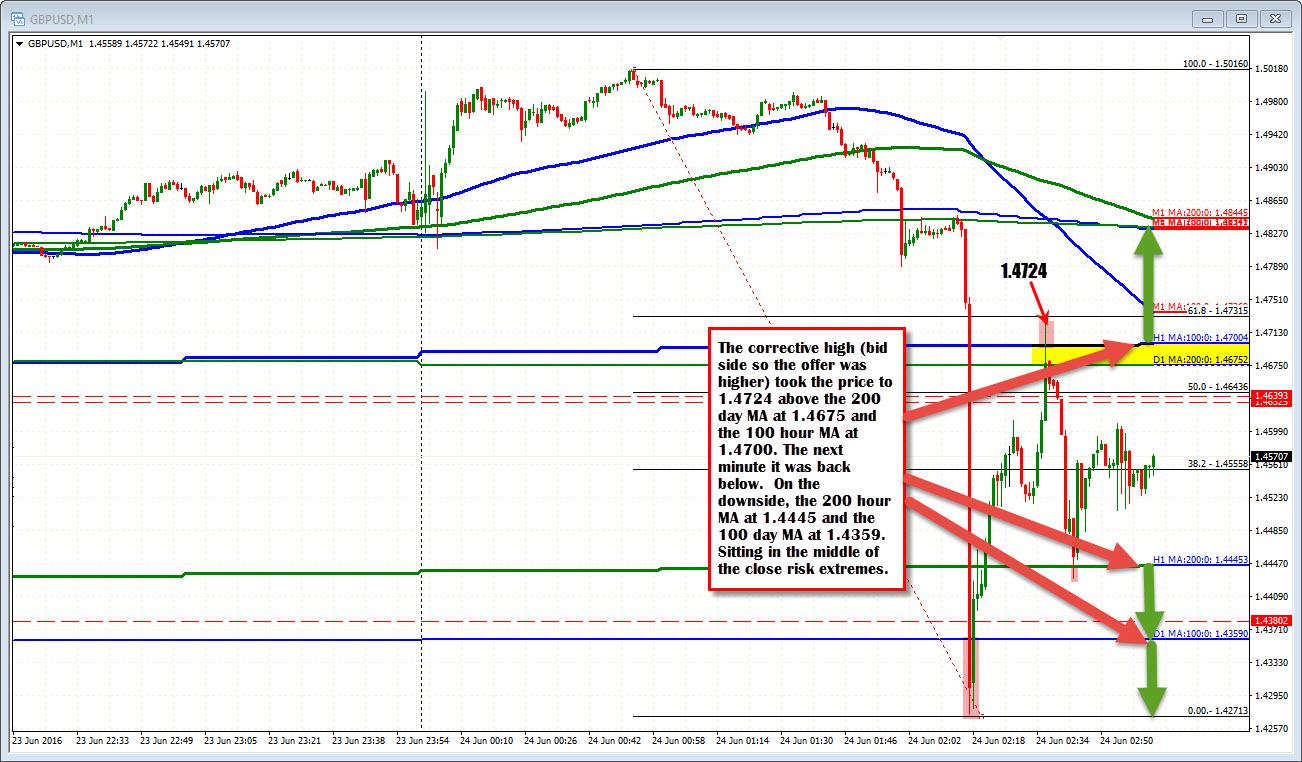

The initial minute fall took the price below the 100 day MA at the 1.43589. The low reached 1.42713. One minute later it was back above.

Nineteen minutes later the high correction took the price above the 200 day MA at 1.4675 and the 100 hour MA at 1.4700. The high bid (the offer was 20 pips or more higher) took the price to 1.4724.

The fall from the high correction point, then took the price to the 200 hour MA at 1.4445 (the low was 1.4430 on the 2nd lowest dip). We are currently sitting between the 1.4700 above and the 1.4445 below. The 1.4359 (100 day MA) is really the key level to get to and through on the downside. The 200 day MA at 1.4675 and 100 hour MA (at the nice round number of 1.4700) is the key level to get to and through on the upside.

Seeing the price move back closer to the high extreme now (at to 1.4650 offer).

Risk remains extremely high. Given the Leave % lead, the expectations before looked for sub 100 day MA. That lasted a minute. 250 pips above that level.

The spreads I am seeing are 15-20 now.

But we are still really early. If 16.4M is the winning target and at 370K vs 344Km, there is still a long way to go. The risk will be long and drawn out and "the market" is waiting it out - making sure to take an ounce of flesh from those at the extremes.

REPEAT: Market, Event and Liquidity risk all at extreme levels. Gamble time.